Nowotny already hit the euro with comments regarding the need for more action to battle the low level of inflation.

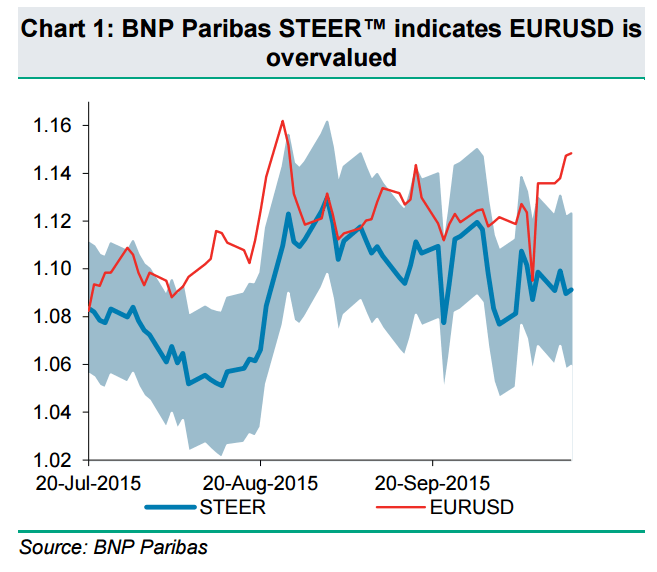

There may be more coming as BNP Panibas sees EUR/USD as overvalued:

Here is their view, courtesy of eFXnews:

In its weekly note to clients, BNP Paribas makes the case for fading EUR/USD rally projecting a significant scope for the pair to fall from current levels. BNPP already followed on that today by establishing a short EUR/USD position.

The following are BNPP’s rationale behind this call along with the details of its EUR/USD short position.

Valuations: “EURUSD levels are starting to look expensive even compared to the very depressed level of US front-end rates,” BNPP argues.

Risk Sentiment: Specifically for EURUSD, BNPP considers the following (simplified) risk scenarios:

“1- Further risk-on – Eurozone capital outflows resume and markets start to reprice Fed hikes = EURUSD lower.

2- Stable risk – Without a strong impulse from risk sentiment, the eurozone’s trade surplus is probably still putting some natural upward pressure on EURUSD. But with valuations already expensive, EUR funding should be more attractive = no clear signal for EURUSD.

3- Return of risk-off – EURUSD continues to rally, which forces the ECB to step up dovish rhetoric and ultimately ease policy = EURUSD first higher, then lower,” BNPP adds.

“The bottom line is that as long as we assume that the Fed and the ECB have a positive sensitivity to risk but are only able to move away from their policies in one direction, namely toward Fed hikes or ECB easing, risk-on should lead to Fed tightening and risk-off to ECB easing. Both outcomes favour a lower EURUSD,” BNPP argues.

In this context, BNPP notes that the key event next week will be the ECB’s rate decision on Thursday 22 October.

“Our economists do not expect a change in policy, but expect the press conference to reiterate Nowotny’s dovish comments earlier this week, highlighting that inflation remains clearly below the ECB’s target. Our economists continue to expect an extension of the ECB’s asset purchase programme (APP) beyond September 2016, most likely to be announced in December 2015,” BNPP projects.

In line with this view, BNPP entered a short EUR/USD position today from 1.1450, with a target at 1.0900, and a stop at 1.1630.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.