As we end a turbulent month, it is easy to notice that EUR/USD has gone a long way from the highs. What’s next? The team at SocGen analyzes:

Here is their view, courtesy of eFXnews:

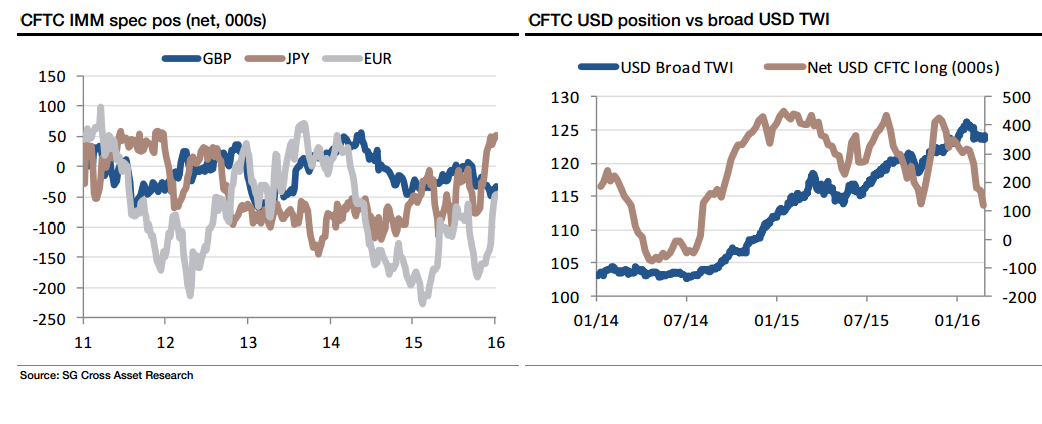

In the week to February 23, Yen longs increased, USD longs were cut back, Euro shorts were cut back and the GBP short actually shrank a little. The yen position highlights bearish risk sentiment…

The smallest EUR short since 2014 however, comes as the inflation divergence acts as a reminder of the US/European economic divide, something that hasn’t been talked about so much recently but, along with the drag on the Euro from ‘Brexit’ fears, can drag EUR/USD down further if Treasury yields find a modicum of stability.

Le Monde has an article about the collapse of French agriculture today (not new or limited to France, but depressing) while all the papers are worried about the migration crisis. Wolfgang Munchau, in the FT, is inevitably the most worried but it won’t take much to accelerate a test of EUR/USD 1.08.

As for sterling, the move last week reflected the relatively light positioning and had somewhat run out of steam by the end of the week. However, what is now very clear indeed, is that the EU referendum campaign will be bloody and very negative. The more the ‘in’ camp stress the dangers of leaving (as opposed to the advantages of staying, the more the market has to take into account how bad a decision to leave would be. As long as polls remain evenly split, the maths for sterling is bad.

So – a respite for risk, more downside to both EUR/USD and GBP/USD but perhaps not for USD/JPY.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.