When there is blood on the streets, that’s the time to invest or as Warren Buffett says “Buy fear, sell greed” well perhaps it is time to take a closer look at the Indian Rupee. The currency has been in free fall since the start of the year as concerns about their budget deficit and inflation have spooked the currency. There is also political uncertainty with the government very unpopular ahead of elections next year and predictions of a hung parliament not doing any favours for the economy.

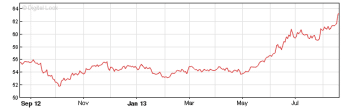

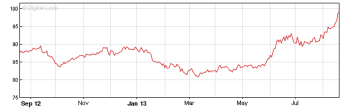

The two tables below illustrate the sharp fall of the Indian Rupee against Sterling and the US Dollar. The currency has fallen approximately 20% in the last 3 months against both the pound and the US dollar!

Last week, restrictions were imposed on how much its citizens and companies can invest abroad. This is supposed to reduce pressure on the Rupee but the currency has fallen further since with the Indian Rupee comfortably above the 100 level against Sterling. This morning the Indian Rupee was trading above 101 against the pound and nearly 65 against the US dollar. This level was unthinkable even a few months ago.

Capital restrictions will adversely impact company profits and tightening capital restrictions will discourage foreign investment.

India’s main concern is the huge current account deficit which is 4.8 per cent of its gross domestic product. The plunging Rupee has raised concerns that the country may have its sovereign credit rating downgraded to “junk” thus encouraging even further falls in the currency. With sentiment weak and business financing conditions and investment growth expected to weaken further, the likelihood of a downgrade increases. A downgrade in its rating would mean higher borrowing costs for Indian companies and thus impact margins and profitability. The falling Rupee has made imports much more expensive and inflation an even greater concern with higher import prices.

The currency is undoubtedly undervalued at current levels and a great place for tourists to visit and stay in its beautiful hotels which are at least 20% cheaper than a few months ago due to the sharp depreciation but there is always an overshoot in the FX markets and the currency could continue to fall a little more but surely we are near the bottom. With all the problems in the Indian economy it is no surprise that it is the worst performing currency in Asia. The country has a very strong domestic economy and has potential to recover from its current state but the record current deficit and slow growth needs to be addressed.

Yesterday, the Reserve Bank of India said it would buy long-dated government bonds worth Rs 8000 crore ( £800 bn/ $1.25bn) through an open market operation on Friday. Perhaps, this will give the currency some stability and act as the catalyst in the Rupee recovering.