EUR/USD is rising with the trouble in the world and HSBC asks us not to be surprised.

Here is their full explanation:

Here is their view, courtesy of eFXnews:

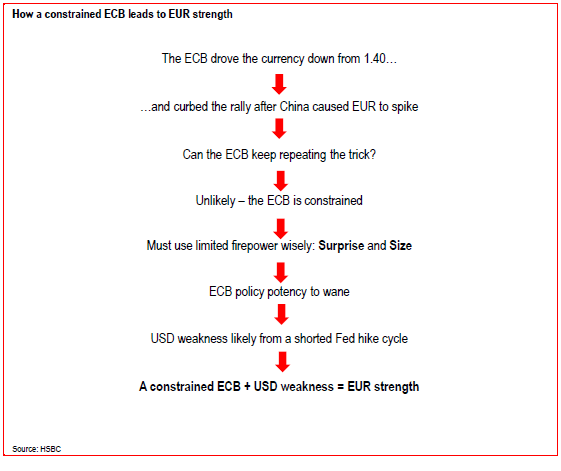

HSBC is out with what is probably one of the strongest contrarian views we have seen so far on the EUR. In its weekly note to clients, HSBC makes the case not only for a stronger EUR but for a weaker USD as well. The following are the key points in HSBC’s argument along with its new EUR/USD forecasts, and a detailed diagram on what will lead to EUR strength.

1- QE and the EUR. “The ECB was the main architect of the fall in the EUR in the second half of 2014, and the central bank still appears committed to curbing what it sees as excessive appreciation of the single currency…In our eyes, levels above 1.15 on EUR-USD are enough to prompt some soft push-back from the ECB, and the recent behaviour suggests that a move heading above 1.20 could trigger real concern at the ECB,” HSBC argues.

2- The 60 billion EUR question: can the ECB repeat the trick? “The ECB is likely to become more and more constrained in its QE activity. In any circumstance, it will need to use its limited ammunition very carefully in the future. We believe that the ECB’s lack of policy options alongside our outlook for a weaker USD after the Fed starts hiking rates will see EUR-USD move higher,” HSBC adds.

3- Despite the Fed, USD weakness ahead. “It is not just the ECB angle that points to a stronger EUR. We believe there is excessive optimism on the USD, especially against G10 currencies. Having seen the end of the USD bull-run against developed market currencies, we could now be on the cusp of a weakening USD trend. The upcoming US tightening cycle could be unconventionally brief, confounding USD bulls relying on the US Federal Reserve to deliver a more aggressive series of rate hikes than is currently priced in,” HSBC argues.

4- USD weakness + ECB’s limited firepower = stronger EUR. “We have two moving parts when it comes to EUR-USD. On the one side sits the Fed and on the other the ECB. The Fed is seen as the hawk while the ECB is the dove. Now we believe the reverse to be true: that the Fed will not deliver to their hawkish dots and that the rate cycle – if it ever gets going – will be shallow and short. The ECB on the other side will not be able to be super dovish. Thus as the market adjusts to a not so hawkish Fed and a constrained ECB the EUR will adjust upwards.

5- New EUR/USD Forecasts: HSBC is now looking for EUR/USD to hit 1.14 by year-end, and 1.20 by end 2016.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.