In our FED preview, we laid out three scenarios, only one USD positive. Here is the view from SEB, which compares today’s event to the moves seen last year:

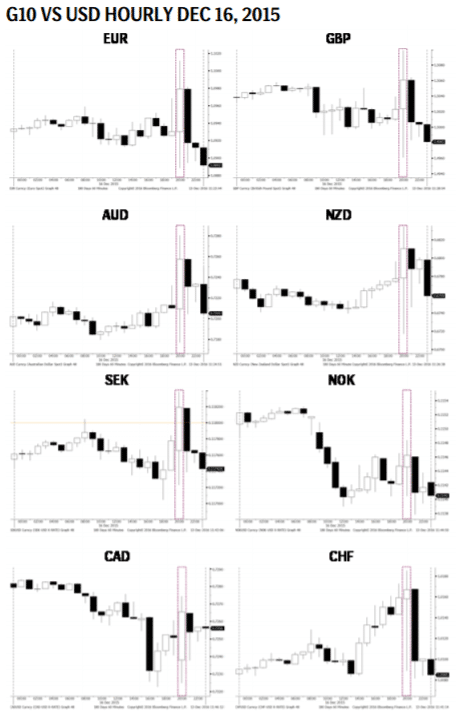

With Fed widely anticipated to hike policy rate Wednesday Dec 14 we have looked at G10 currency reactions following the hike Dec 16, 2015 as well as compared speculative positioning around the previous hike and today.

Following are our main observations.

1. USD began to weaken in the afternoon (CET) before the rate announcement.

2. Continued to weaken versus all G10 currencies the first hour after the hike was announced

3. USD strengthened versus all but two (CAD and JPY) the rest of the day.

4. Continued to strengthen the day after versus all other G10 currencies.

5. Speculative positioning reveals a greater USD conviction now compared to 2015

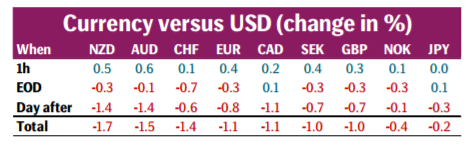

The above conclusions are based on the table below in combination with the intraday charts. The table shows the change (1) one hour after the announcement (2) End-Of-Day and (3) the day after. It is sorted in order of the size of the total change.

When combining the reaction after the hike on Dec 16 and the entire day of Dec 17, NZD weakened the most and JPY the least.

However, looking at the reaction the day after in normalized change1 shows CAD as the weakest currency followed by AUD and NZD in third place 2016 VS. 2015 The futures implied probability for a 25bps hike was 76% in 2015 while today it is 93% (and 7% for a 50bps hike).

Thus the hike appears even more discounted by markets compared to 2015. This is also supported by the Bloomberg survey where 78 of 78 economists expects a 25bps hike Dec 16, 2016 compared to 98 of 101 back in 2015.