EUR/USD dipped below 1.10 in reaction to Draghi’s drag. Will it confirm the break on the NFP?

Here is how to sell the pair into the Non-Farm Payrolls, with some targets.

Update: Non-Farm Payrolls + 295K – excellent news – USD higher

Here is their view, courtesy of eFXnews:

Looking ahead, investor focus shifts to Friday’s US labour data. At 245k (cons: 235k, prev: 257k) our economists expect that February payrolls will surprise positively and that it is expected to be reflected in a further falling employment rate (CA-CIB forecast: 5.6%, cons: 5.6%, prev: 5.7%). If so, investors’ Fed rate expectations will continue to be supported to the benefit of the USD. However, it must be considered too that Friday’s outcome is subject to several downside risks.

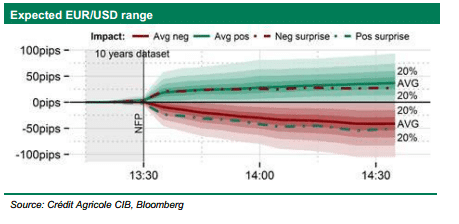

According to our FX Execution Mapper payrolls should produce an expected trading range of around 80pips. Recent history has shown payrolls to have an asymmetric influence upon EUR/USD with positive surprises prompting a larger negative reaction than their positive counterparts. Following the Yellen testimony last week, however, that NFPs relationship has likely flipped with sentiment now being more sensitive to a negative surprise.

This sets up an opportunity for investors to sell any larger than 25-50pip EUR/USD rally following any negative NFP surprise post the release, with a stop of at least 100pips. This tactical strategy is based on the assumption that Friday’s data will not have any sustainable impact on the Fed unless wage developments weaken considerably.

If short EUR/USD already we recommend keeping that position. We stay short EUR/USD, targeting a move to 1.0600 over the coming few weeks.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.