- Turkish lira (TRY) recovered 5 percent on Tuesday but failed to dissuade investors from buying put options.

- The USD/TRY risk reversals hit a record high of 11.15 on Tuesday and were last seen at 10.97.

The Turkish lira (TRY) rose more than 5% to around 6.3 to the dollar on Tuesday, after falling 20% in the previous four working days.

As of writing, the USD/TRY pair is trading flat-lined around 6.34. Despite TRY’s recovery from record lows, the put options (bearish bets) continue to attract demand.

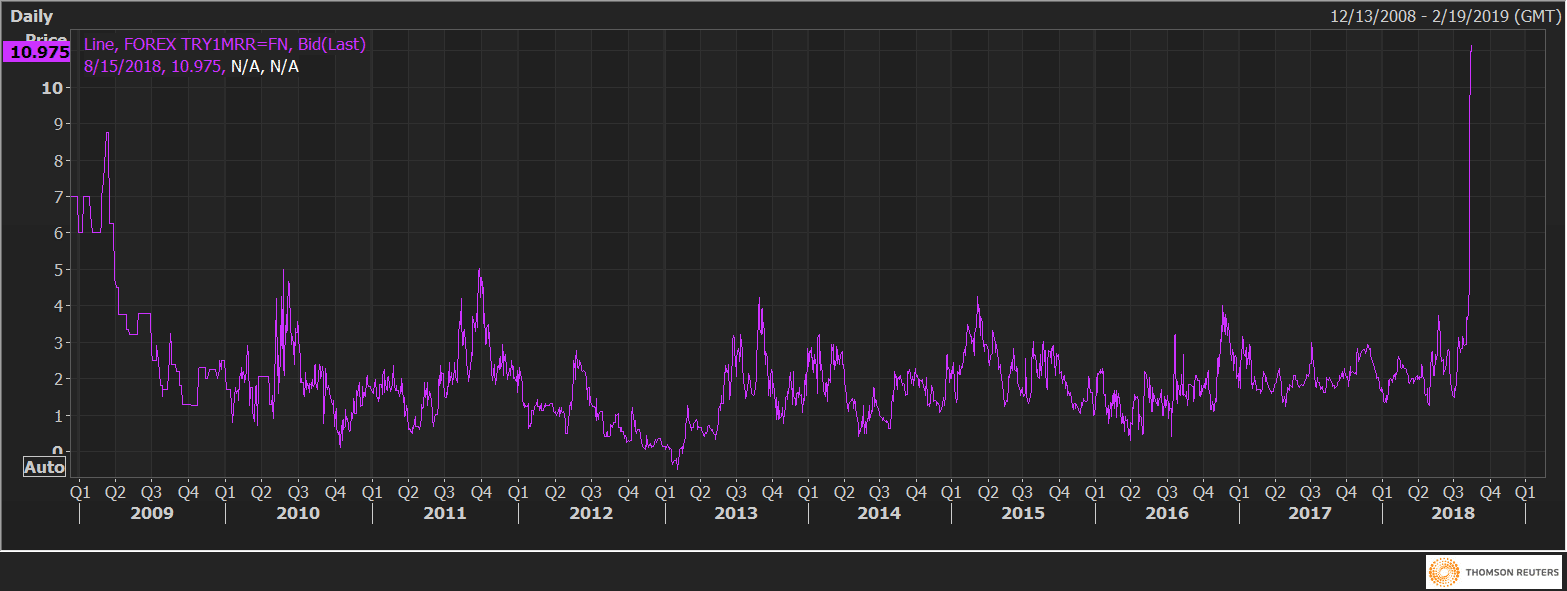

For instance, the USD/TRY one-month 25 delta risk reversals (TRY1MRR) jumped to 11.15 on Tuesday, representing record high implied volatility premium for TRY put options. At press time, the implied volatility premium for the TRY puts stands at 10.97.

The elevated put premium indicates the options market is likely anticipating another round of sell-off in the TRY.

TRY1MRR