The US dollar is finding less love these days, especially against the yen. The team at Creidt Suisse turns bearish on the greenback for the first time since mid 2014 and explains:

Here is their view, courtesy of eFXnews:

Risk aversion in markets continues to play out, with our technical team now targeting an S&P 500 level near 1600, a 25% peak to trough decline.

From an FX perspective, the key developments are as follows:

1. A growing fear that monetary policy is now “pushing on a string,” at least from an FX perspective. EUR and JPY are materially stronger now than levels before ECB chief Draghi hinted at more easing and the BoJ introduction of negative rates in January.

2. An obvious end to the monetary policy divergence trade when looking at rate differentials, as we discussed in depth last week.

Last week our advice was to avoid fading EUR and JPY weakness against the USD.

This week we go further and for the first time in a very long time become outright bullish on both the EUR and JPY on a 3m horizon. We turn bearish on the USD against the EUR and JPY on a 3m horizon for the first time since the structural USD rally started in mid-2014.

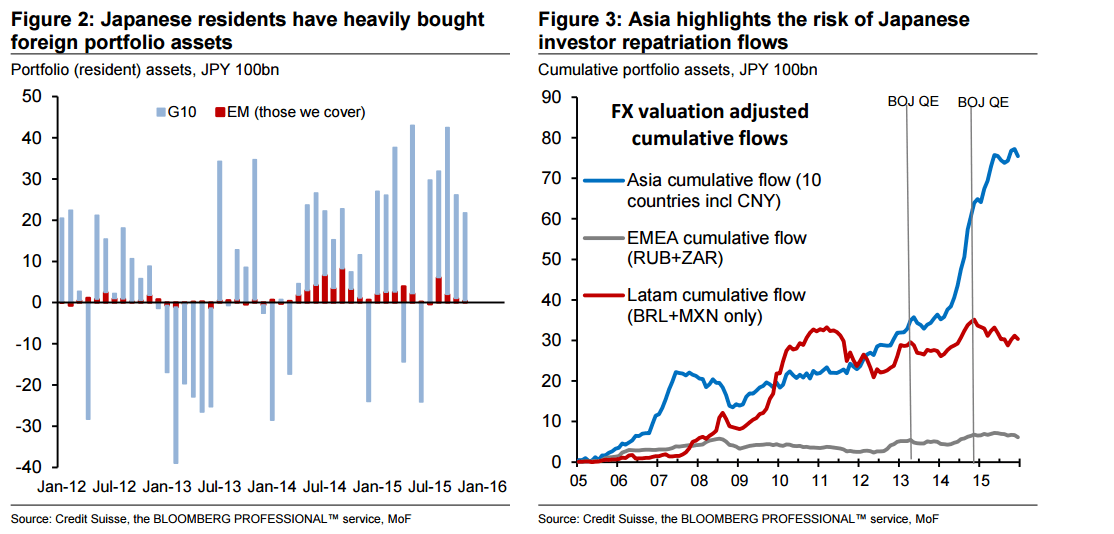

More radically, we change our 12m USDJPY forecast to 105. This week’s move below 2015 lows around 115.85 makes it more apparent to us that USDJPY seems unwilling to respect any “lines in the sand.” And this is in spite of the entire JGB yield curve out to 10 years responding to the BoJ move by trading negative rates. This is problematic given the tremendous amount of foreign asset buying – likely largely unhedged – that Japanese investors have indulged in for the last three years.

How do these developments impact our EURUSD forecast? We are raising our 3m forecast to 1.17, close to the one-year highs posted in August. Like the JPY, the EUR is a funding currency. And like Japanese investors, Europeans have ventured away from home in search of foreign assets. Any unwinding of such flows in a risk-off environment is EUR bullish, especially in light of the euro area’s massive 3.0% of GDP current account surplus.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.