The trade deficit in the U.S. shrunk in December compared to the previous month, exceeding half a trillion dollars for the whole of 2016, something which the U.S. President Trump has vowed to narrow by boosting economic growth domestically.

The U.S. foreign trade gap for goods and services fell 3.2% in December to a seasonally adjusted $44.26 billion, data from the U.S. Commerce Department showed last week. It was slightly smaller than the forecasts of $44.7 billion.

Exports increased 2.7% during the month, which included an increase in sales of civilian aircraft and parts while imports to the U.S. rose 1.5% led by increased car imports.

Commenting on the report, Andrew Hunter from Capital Economics, said that he expects the nominal trade deficit to continue widening in the coming months on account of rising costs for oil imports. However, he said that U.S. exports would continue to strengthen as the drag from the dollar’s sharp exchange rate movement in 2014 and 2015 will fade and the surveys from ISM and Markit have already suggested that the pickup in global demand will spur exports.

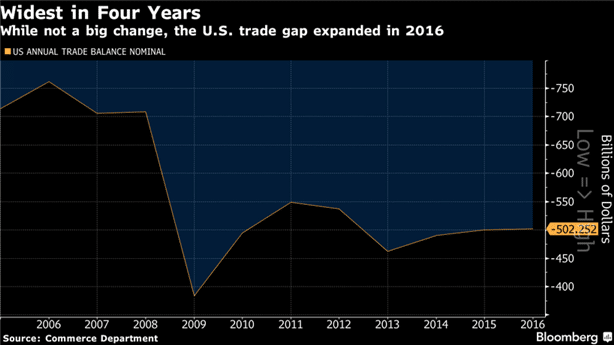

For the whole year, the U.S. posted a foreign trade deficit of $502.25 billion. It has been the highest annual level recorded since 2012 and increased 0.4% from the year before. The trade deficit recorded was about 2.7% of the GDP in 2016, posting a modest decline from 2.8% of GDP in 2015.

In the last year alone, the U.S. ran a trade surplus of $247.82 billion in the services sector, while the goods sector posted a trade deficit of $750.07 billion. Regarding volume, both exports and imports were down 2.3% and 1.8% respectively in 2016, compared to a year ago.

In the final three months of the year, weaker exports and increasing pace of imports weighed on the output growth. The Commerce Department estimated that the U.S. GDP expanded at a pace of 1.9% annually in the fourth quarter with net exports posting a drag.

However, regarding goods alone, the U.S. – China trade deficit narrowed in 2015 to $347 billion, while running up a sizable deficit against other trading partners including Japan, Germany, and Mexico. Most of the countries in the list were often named by President Trump, who suggested importing border taxes, especially on imports from Mexico.

Closing the trade deficit is, however, going to be a challenging task for President Trump, who has reiterated that he would boost economic growth and support manufacturing jobs in the U.S. by reducing the deficit. Wilbur Ross, the President’s pick for the Commerce Department said that expanding U.S. exports would be his number one priority.

Mr. Trump plans to do this by negotiating better trade deals with existing trade partners while threatening to impose import tariffs if need be. However, the U.S. has been consistently posting trade deficits for nearly a quarter of a century with the gap widening as China rose to prominence on the global playing field.

The previous Obama-led administration set off on a similar path to boost the overall economic growth in 2010 with a goal of doubling the exports over five years. However, the previous administration fell short of the market as global demand shrunk alongside a stronger U.S. dollar, making U.S. made products more expensive.

The U.S. dollar continued to strengthen since Trump’s election victory in November and is now likely to cause a headwind as exports could continue to take a hit against a stronger exchange rate which is likely to create more uncertainty as investors await further details from the Trump administration regarding taxes and trade which is likely to be one of the cornerstones of the Trump policy.