Good news for the British housing sector: the construction PMI jumps back into growth territory, reaching 50.8 points in October, well above expectations.

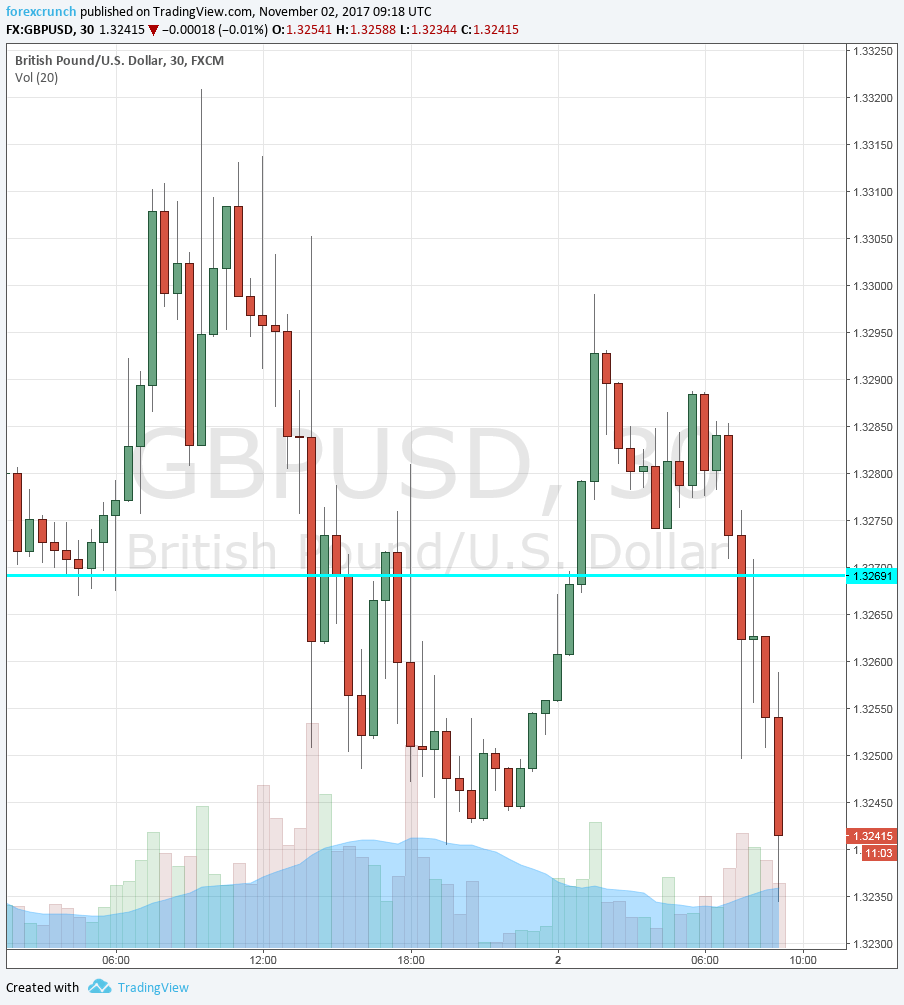

GBP/USD, which was falling ahead of the release, is now bouncing a bit back. However, moves will likely remain limited ahead of the BOE decision at 12:00 GMT.

Markit’s construction managers’ purchasing index for October was expected to remain unchanged at 48.1 points, below the 50-point threshold that separates expansion from contraction. Yesterday’s manufacturing PMI beat expectations with 56.3. The most important release is for the services sector, which will be out tomorrow. Nevertheless, there is a bigger event on the docket today.

GBP/USD was dropping ahead of the publication, erasing some of its earlier gains. It traded around 1.3250. Cable tends to front-run events.

The big event for today is the rate decision by the BOE. Mark Carney and his colleagues are expected to raise the interest rate for the first time since 2007 in a move that will undo the post-Brexit cut of 2016. The big question is: will they continue hiking or is it only a one-off?

Here is our preview: BOE hike preview: buy the rumor, sell the fact?