The construction sector joins the manufacturing sector in beating expectations: a score of 54.2 is a beat of 1.4 points.

GBP/USD ticks up very marginally though.

In a separate report, consumer credit is also a beat with 1.926 billion, above 1.6 billion expected. Mortgage lending stands at 3.157 million, below 3.5 million predicted. However, approvals of mortgages are better than predicted with 67,505.

Markit was expected to report that the UK’s construction purchasing managers’ index for December would remain unchanged at 52.8 points, reflecting slow growth.

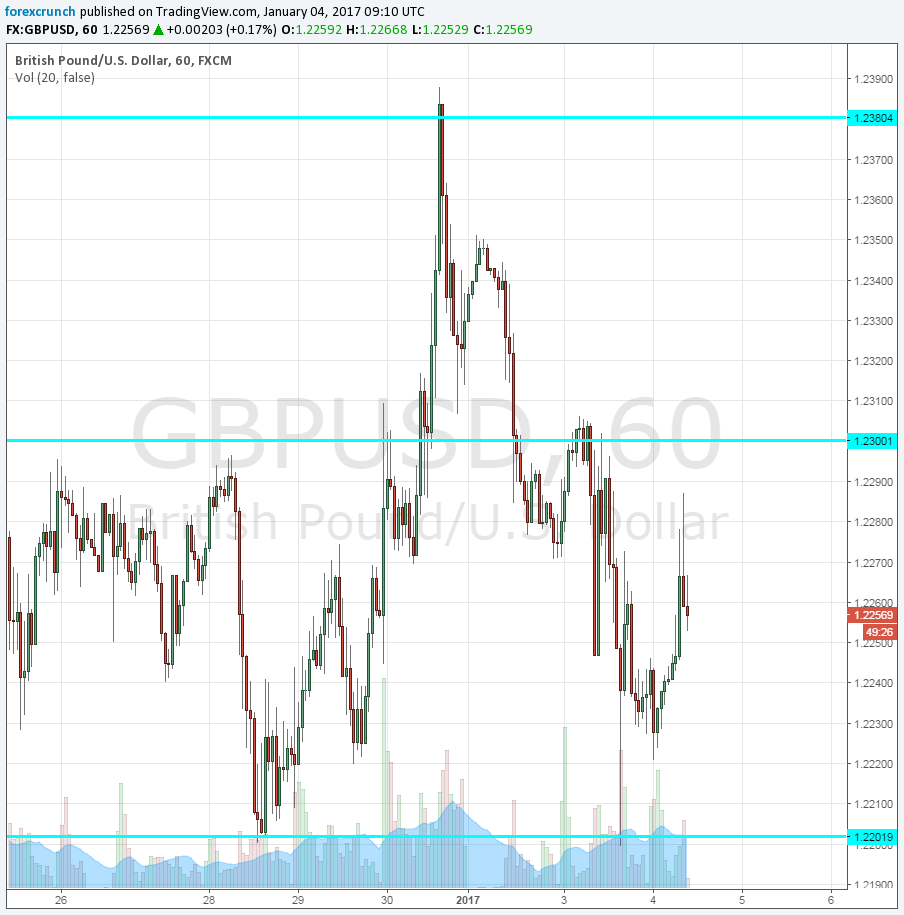

GBP/USD traded around 1.2250 ahead of the publication, slightly higher on the day but well within the 1.22-1.23 range.

Yesterday’s Manufacturing PMI beat expectations. The third and last PMI is scheduled for tomorrow, for the services sector. This is the most important publication, due to the sheer size of that sector.

More: GBP/USD: between a soft Brexit and hard reality

Further support awaits at 1.21. Higher resistance is at 1.2380. GBP/USD faces a turbulent year with the official announcement of Brexit due in March – the famous Article 50.