- The final read for UK Q4 GDP is expected to confirm the previous figures.

- A revision of the yearly growth figure and investment could trigger short-term action.

- Brexit remains left, right, and center for GBP/USD movements.

The UK publishes its final Gross Domestic Product report for the fourth quarter of 2018 on Friday, March 29th, at 9:30 GMT.

The final report is projected to confirm the initial read: 0.2% QoQ and 1.3% YoY. Both figures are unimpressive in absolute terms but in line with the slowdown that the world experienced at the end of the year. The euro-zone grew by 0.2% at the same time.

Revisions to the quarterly number are quite uncommon. Any surprising change to 0.3% or higher will push the pair higher, and a downgrade to 0.1% or no quarterly growth could send it down.

However, given the past, a change to the yearly number is more likely. Also here, while modifications are more common, they tend to have a more muted impact than the quarterly one.

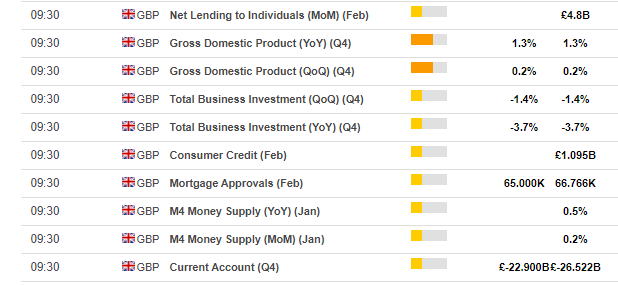

There are quite a few other components, and other data is also released at the same time. The current account deficit, the weak growth in M4 Money Supply and next lending will be of interest.

Investment stands out among the components. Total Business Investment fell by 1.4% QoQ and 3.7% YoY, worrying numbers. Confirmation of these figures will probably weigh on Sterling, regardless of expectations. Any downgrade could be even worse.

And there is a reason why investments are falling. It’s called Brexit.

While the report is for Q4, Brexit uncertainty continued well into Q1 2019. The day of the publication, March 29th, was the original day the UK was supposed to leave the EU. The new date is April 12th, and there’s no end in sight.

Every rumor related to the UK’s exit from the EU tends to have an outsized effect while meaningful data such as retail sales, jobless data, and inflation figures, has a minor impact. It will unlikely be different for the GDP report.

All in all, GBP/USD will likely move on any topline revision and may suffer from headlines emphasizing the pause in investment. This effect will probably be limited in the number of pips and also in the period.