- The UK is projected to report a 1.7% contraction in the first quarter.

- Optimism about a vaccine-led recovery from the second quarter onward is baked into the price.

- A reminder of past weakness may trigger a much-needed correction after the big breakout.

Flowers are blossoming, birds are chirping and Brits can finally do more activity as restrictions are gradually lifted. That is one of the reasons for the pound’s massive rally above 1.40.

While Britain’s successful vaccination campaign kicked off already in December, the economy still struggled in the first quarter of 2021 – and Gross Domestic Product figures for that period may trigger some sterling selling,

Prime Minister Boris Johnson has been enjoying his party’s success in local and regional elections – another pound-booster – but in early January, he put the country into lockdown. The B.1.1.7 COVID-19 variant, also known as the Kent or British strain, raged through the country.

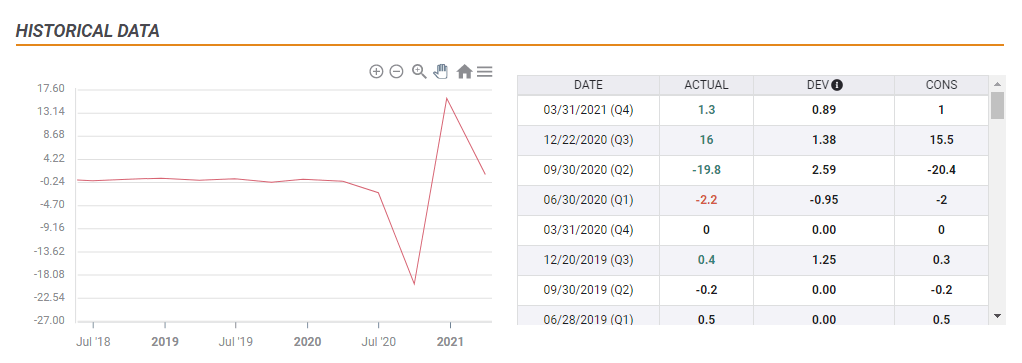

The government took the first steps to exit these measures only in early March, and that is why economists expect economic output to drop by 1.7% quarterly. It is essential to note that these estimates are based on monthly GDP figures for January and February, thus including the worst period.

While the three previous publications have surprised to the upside, they have been minimal. Moreover, market participants have already learned that the impact of the new lockdowns was relatively moderate in comparison to that of the first shuttering. All this implies that the chance of an upside surprise is minimal.

The comeback from the lockdown and massive US fiscal stimulus have likely boosted the economy in the second quarter or even beforehand. Monthly data for March, released alongside the quarterly statistic, could already turn positive. Nevertheless, there is room for correction in GBP/USD.

Cable correction

Apart from the recovery, and UK politics, cable also climbed in response to America’s bitterly disappointing Nonfarm Payrolls data. The sell-off in the dollar has gone far and may see a pullback. With GBP/USD already stretched – the Relative Strength Index (RSI) is at overbought territory on some timeframes – the GDP report could trigger a downfall.

It would probably take a substantial beat of expectations to add fuel to sterling’s rally. If the economy contracted by only 1%, or shocks by growing in the first quarter, the pound could rise. Conversely, a squeeze of over 2% or 2.5% would result in a more significant downside correction.

Apart from showing markets that Britain struggled with the lockdown, the data could also serve as a reminder of Brexit. The UK’s EU exit has been causing additional paperwork for goods and also has also left unresolved issues. Growth figures would serve as a reminder and as a reality check of these lingering issues.

Will any such slide serve as a change of course or only a correction? As markets are forward-looking and the future looks brighter, a temporary dip is more likely than a long-lasting downfall.

Conclusion

The UK is set to report a contraction of 1.7% in its output in the first quarter, due to its lockdown and also Brexit. The data may trigger a much-needed correction in GBP/USD.