- Economists expect a contraction of over 20% in the UK’s economic output in Q2, worse than other developed economies.

- Figures for April and May suggest a more moderate decline.

- Recent UK labor statistics point to the role of the government in propping up the economy.

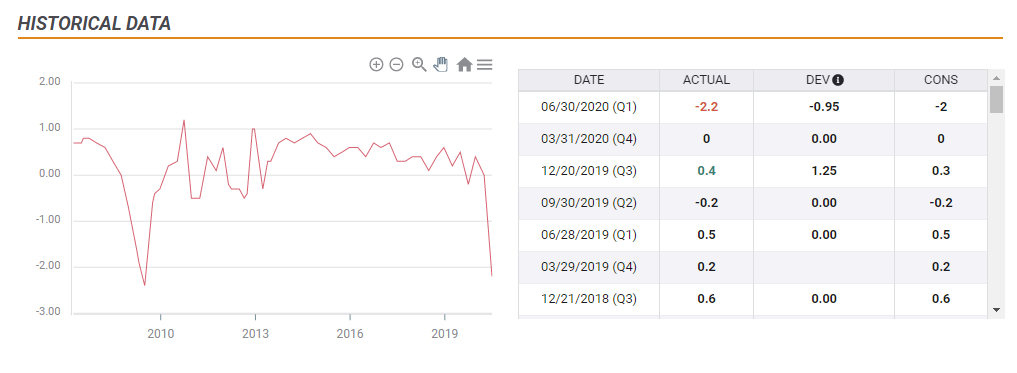

One fifth lower – that is what the economic calendar is showing for the British economy in the second quarter of 2020. Gross Domestic Product is set to fall by 20.2% after edging 2.2% lower in the first three months of the year.

However, there are three reasons to expect a better outcome.

1) International comparison

While Britain does not compare well on the health front – suffering the highest death toll in Europe – its economic downfall is unlikely to exceed the worst-hit countries. Spain’s economy contracted by 18.5%, France by 13.8%, Italy by 12.4%, and Germany by 10.1%. America’s output dropped by 9.5% quarterly.

Britain’s contraction in the first quarter was relatively moderate in the first quarter, and that may lead to catching on with a sharper squeeze in the spring. However, the UK’s early resilience may repeat itself – that argument goes both ways.

The UK’s first-quarter contraction was more moderate than at the peak of the 2008-2009 crisis:

2) Monthly figures are upbeat

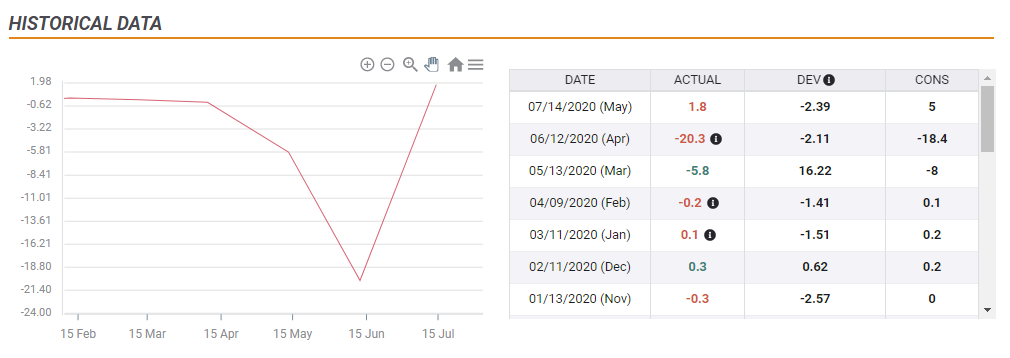

In the past couple of years, the UK publishes GDP figures on a monthly basis. Output declined by 20.3% in April, close to expectations for the full quarter. However, it benefited from a bounce of sorts in May – 1.8%.

May’s increase came amid the gradual reopening of the economy, which began early that month. That removal of restrictions continued in June. While Britain’s relaxation of rules was slow and accompanied by local lockdowns, the trend was of reopening.

There is high probability that output expand in June – further softening April’s downfall and pushing quarterly contraction below that 20% mark.

3) June’s figures are upbeat

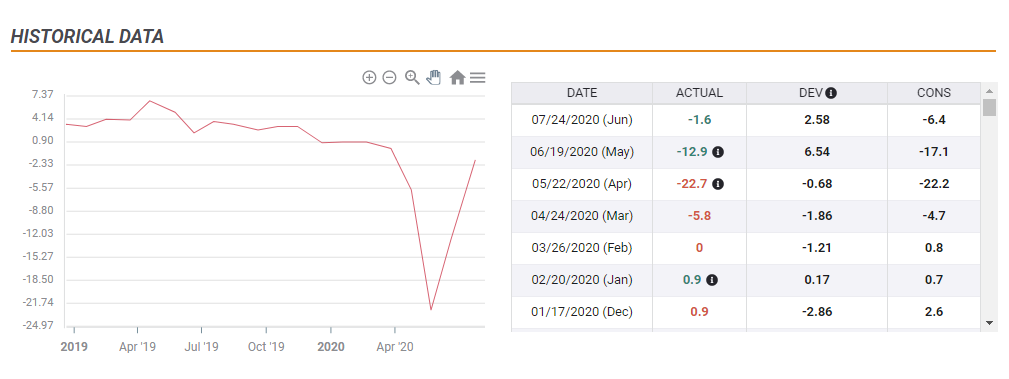

UK job figures for June were robust – showing the unemployment rate remained at 3.9%. That resilience of the labor market is a result of the government’s successful furlough scheme. Westminster keeps workers attached to their positions while receiving most of their salaries.

That cash pushed consumption higher, as seen in year over year retail sales. June’s expenditure was only 1.6% lower than in the previous year.

All in all, there is a high chance that UK GDP dropped by less than expected in June.

GBP/USD reaction

That opens the door to gains for GBP/USD. However, it is essential to note that investors have likely bumped up their projections after the jobs data. Moreover, the pound is also influenced by other factors such as the current state of coronavirus, Brexit uncertainty, and more.

GBP/USD is also dependent on the global sentiment which influences the US dollar. Russia’s announcement of a vaccine received a lukewarm response by scientists, but has been supporting markets and depressing the dollar. On the other hand, the impasse in Washington around the next relief package is weighing on sentiment and keeping the greenback bid.

Conclusion

UK second-quarter GDP likely dropped, confirming a recession – yet probably not by around 20%. A beat may boost the pound, yet expectations may have already been adjusted. A surprising fall of over 20% would send sterling lower.