Headline inflation comes at 3%, as expected. Core inflation also meets the early forecasts and stands at 2.7%. The RPI slightly missed expectations and remained at 3.9%. The House Price Index also fell short of projections and stands at 5% y/y. PPI Input rose by only 0.4% m/m, below expectations. All in all, the main figures came out as expected and some second-tier numbers missed.

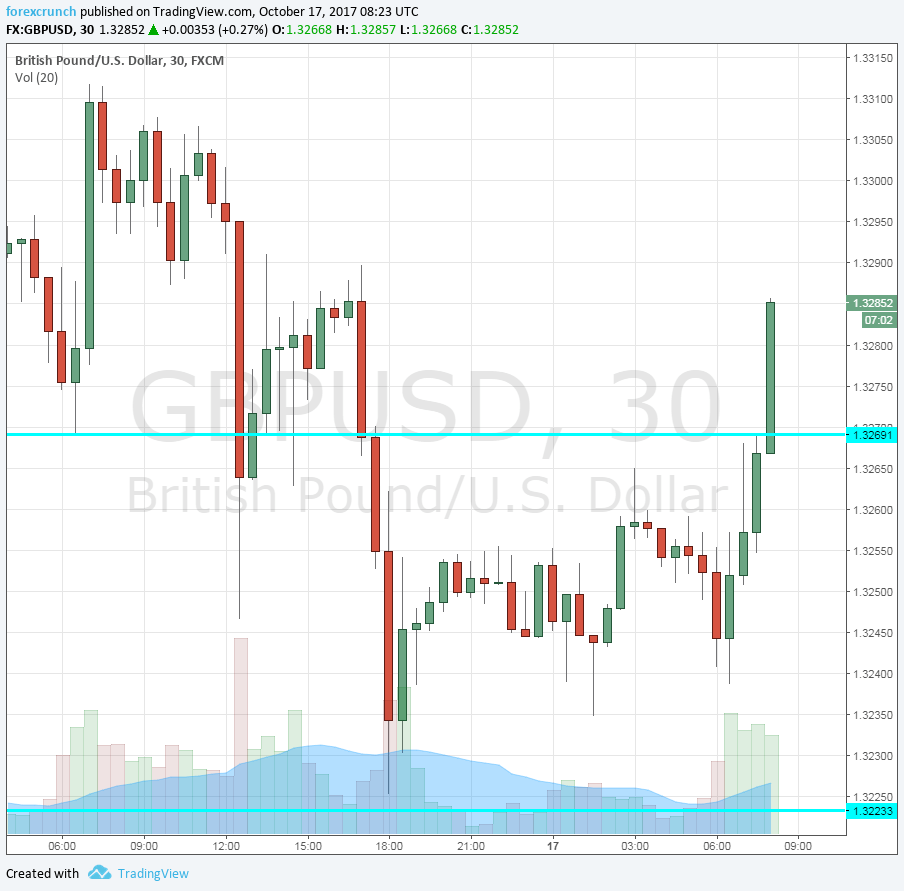

GBP/USD was moving upwards ahead of the publication and is now reversing these gains, all within the range.

The UK was expected to report yet another rise in the annual level of inflation: from 2.9% in August to the round 3% level in September. The Bank of England’s goal is to have inflation between 1% to 3%.

Core CPI carried expectations for remaining at 2.7%. The Retail Price Index (RPI) carried expectations for a rise from 3.9% to 4%.

A rate hike in November seems like a done deal: Mark Carney and his colleagues more than hinted about it. However, it is unclear if it will only be a “one and done”, reversing the post-Brexit cut from August 2016, or the beginning of a tightening cycle. The BOE is not keen on raising rates too quickly given the economic uncertainty. However, if prices continue rising and if credit continues booming, they may be forced to act.

Brexit negotiations are stuck in a deadlock over the divorce bill, and this weighs on the pound.

GBP/USD traded around 1.3280 ahead of the publication. Support awaits at 1.3230 and resistance only at 1.3370.

More: GBP/USD is becoming complicated, like Brexit negotiations