Higher than expected inflation in the UK: 1.2% y/y. Core CPI is at 1.4% y/y, both above predictions. Month over month, no surprises were recorded. Looking forward, PPI Input dropped by 1.1%, more than expected, implying not-too-hot CPI later on. However, at the moment, consumers are feeling the heat. The RPI is up to 2.2%. The HPI is down to 6.9% y/y.

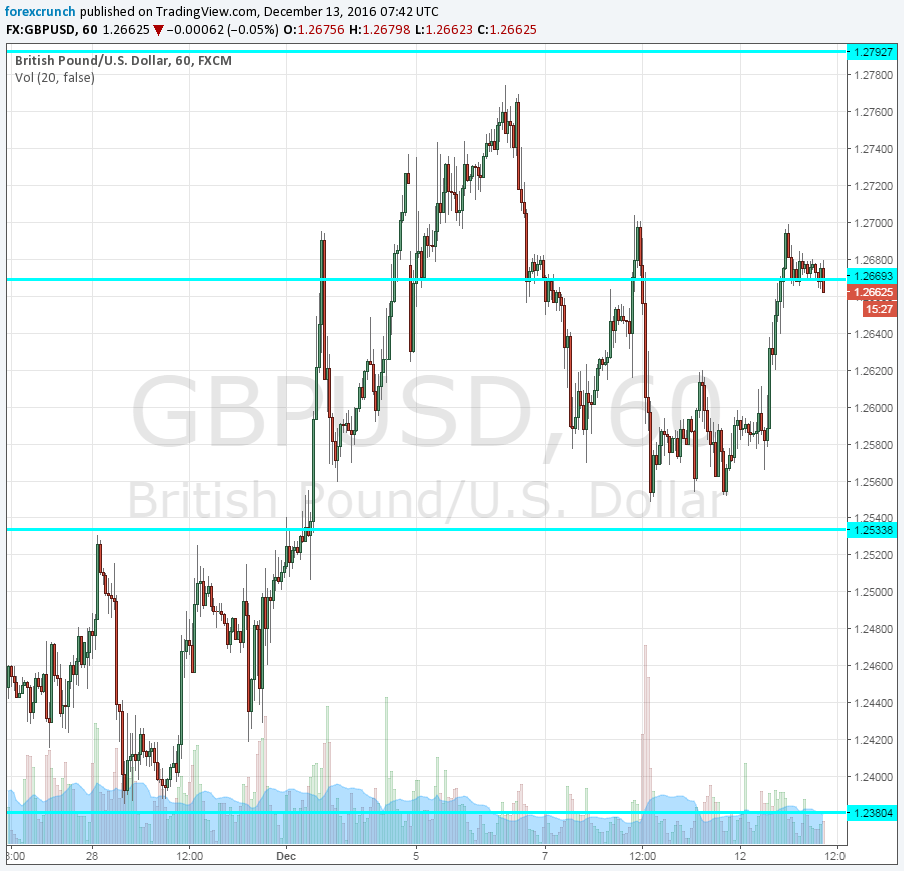

GBP/USD had already advanced ahead of the publication and consolidates around 1.2690. Markets often front-run data releases in the UK and leaks or suspicion of leaks is also a thing.

Prices in the UK CPI were expected to rise by 1.1% y/y in November, after 0.9% in October. Month over month, a rise of 0.2% was on the cards. Core CPI was projected to rise by 1.3% after 1.2% beforehand. PPI Input, which leaped by 4.6% in October, was predicted to slide by 0.4%. Producer prices eventually feed into consumer prices. The Retail Price Index carried expectations for a rise on 2.1% after 2%.

GBP/USD was trading around 1.2660, closer to the higher end of the recent trading ranges. The pound took advantage of the dollar’s weakness.

More: Currency of the week GBP/USD: Soft Brexit or Hard Reality?