Prices are rising at a faster clip than expected. Month over month, headline CPI rose by 0.3%, above 0.2% expected. Year over year, the advance is already 2.9% in May, also beyond 2.7% projected. It is not only energy. Core CPI follows through to 2.6%, above 2.4% expected. These are the highest levels since 2012.

The Bank of England now has a tougher dilemma. They can raise rates in order to push the pound higher and lower the prices of imported goods. However, raising interest rates also means cooling demand. And this is not a good time to curb demand.

The pound is still reeling from the indecisive UK elections. The political scene is quite messy, with Theresa May’s political future in peril.

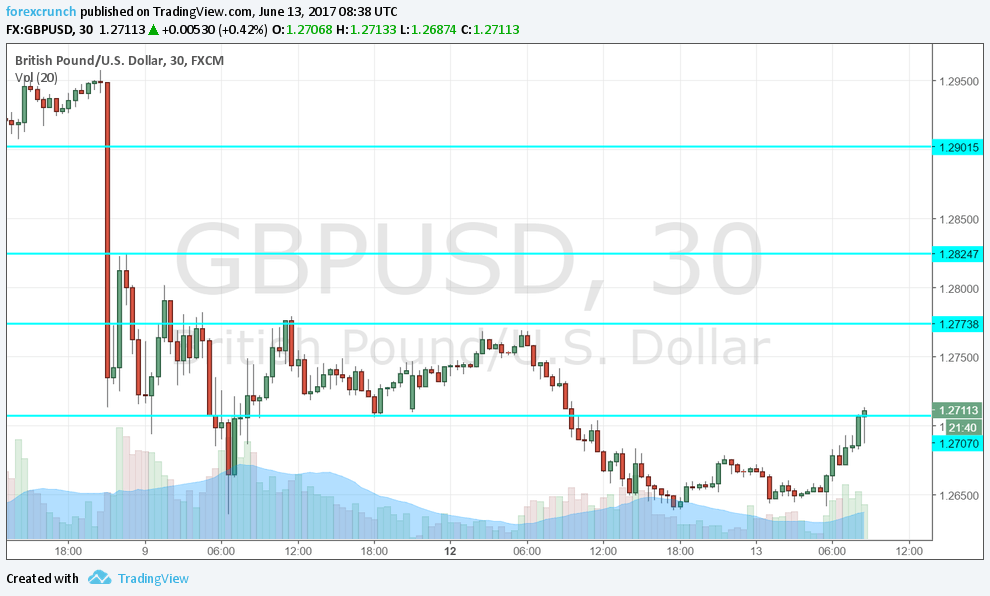

GBP/USD is bouncing from the lows, hitting the 1.27 line after trading as low as 1.2641. The move to the upside began ahead of the publication. Were there rumours? Or was it a leak?

Resistance is at 1.27, followed by 1.2770 and 1.27840. Support is at 1.2615.

More: GBP/USD – more downside to 1.21? Two opinions

The UK elections turned from a non-event that was supposed to provide May with a personal mandate to a total mess that could make Brexit much messier.