- Britain’s unemployment rate for June and jobless claims for July will likely remain upbeat.

- The UK’s labor market has been holding up thanks to the government’s successful furlough scheme.

- GBP.USD has room to extend the BOE-fueled gains.

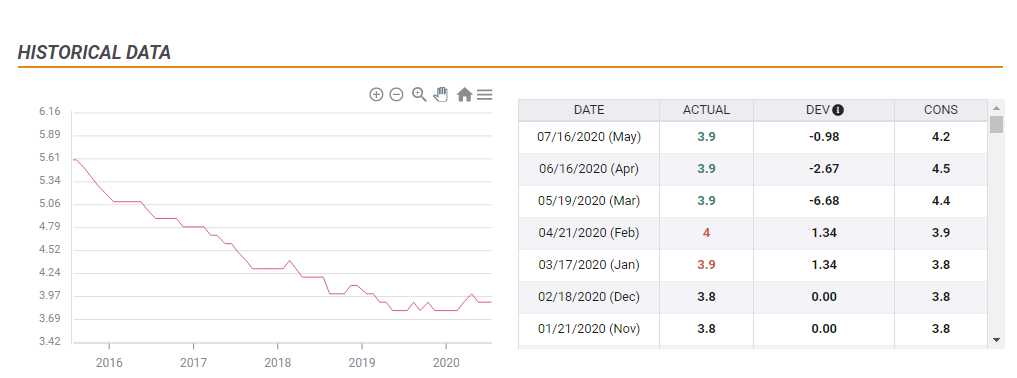

Pandemic, what pandemic? That may the reaction for anyone looking at the UK’s unemployment rate – a remarkable 3.9% in May, deep into the crisis and no different than January, when Brexit was all the rage.

Britain has had its share of suffering from COVID-19 – with one of the world’s highest death rates and a near-death experience for Prime Minister Boris Johnson. Nevertheless, the economic response has been far better than the health one.

The jewel in the crown is the government’s furlough scheme – paying workers most of their salaries while they are unable to work. Another program supports small businesses and has been hailed as efficient and effective.

Economists expect June’s jobless rate to remain at 3.9%, and after three months of positive surprises, that makes perfect sense.

If Britain’s official unemployment rate remains depressed, it would support the pound. An increase to 4% would likely be shrugged off, while only 4.1% or higher – returning to levels seen in 2018 – would be worrying.

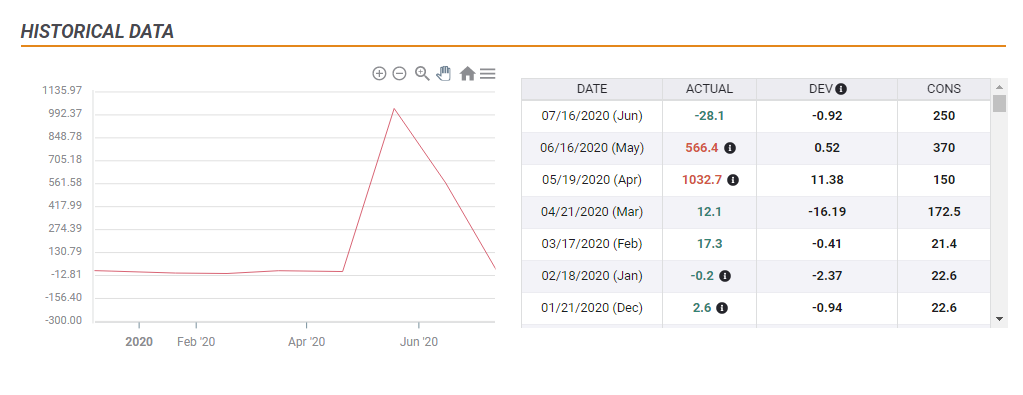

The second significant statistic is Claimant Count Change which is for July, a more recent figure shot above one million in April and hit around half a million in May. That was far above the double-digit fluctuations seen in the pre-pandemic era.

However, after these two terrible months, applications dropped by 28,1000 in June. The ongoing gradual reopening in July has likely pushed claims lower despite the hiccups in Leicester and later Manchester and other areas.

It would take a substantial increase in monthly applications to send sterling lower.

Average earnings are set to remain at low levels. Including bonuses, wages are projected to have dropped by 0.8% in June, worse than -0.3% in May. Excluding them, a meager growth rate of 0.4% is forecast, down from 0.7% previously.

Nevertheless, disregarding salaries is one of the changes that coronavirus has brought to the market reaction to the jobs report. The focus is on jobs that depend on the virus – wages and inflation have lost their importance.

GBP/USD bias and reactions

While the BOE said that risks are skewed to the downside, it upgraded 2020 growth forecasts from the abyss of -14% to a more reasonable -9.5%. It also pointed to robust high-frequency data Andrew Bailey, Governor of the Bank of England, stressed that setting negative rates is not currently on the cards.

More BOE Quick Analysis: Three pound-positive on Super Thursday open door to new highs

The dollar remains on the back foot amid a stuttering US economy, hit hard by COVID-19 and politicians’ feet-dragging on the next fiscal stimulus.

An upbeat or an employment report that meets expectations could continue supporting the pound. The wind is blowing in favor of sterling after the Bank of England painted a relatively rosy picture. A truly horrible report – potentially a mix of a leap in June’s unemployment rate and a surge in July’s claims is needed to change the picture.

Conclusion

The UK’s upcoming labor figures will likely remain robust thanks to the government’s largesse – the furlough scheme is set to run through at least October. The pound needs only minor support to continue rising after the boost from the BOE.