The UK manufacturing sector is set to grow at a robust pace. The manufacturing PMI stands at 57.3, a big beat on expectations. Are British manufacturers optimistic about the post-Brexit world?

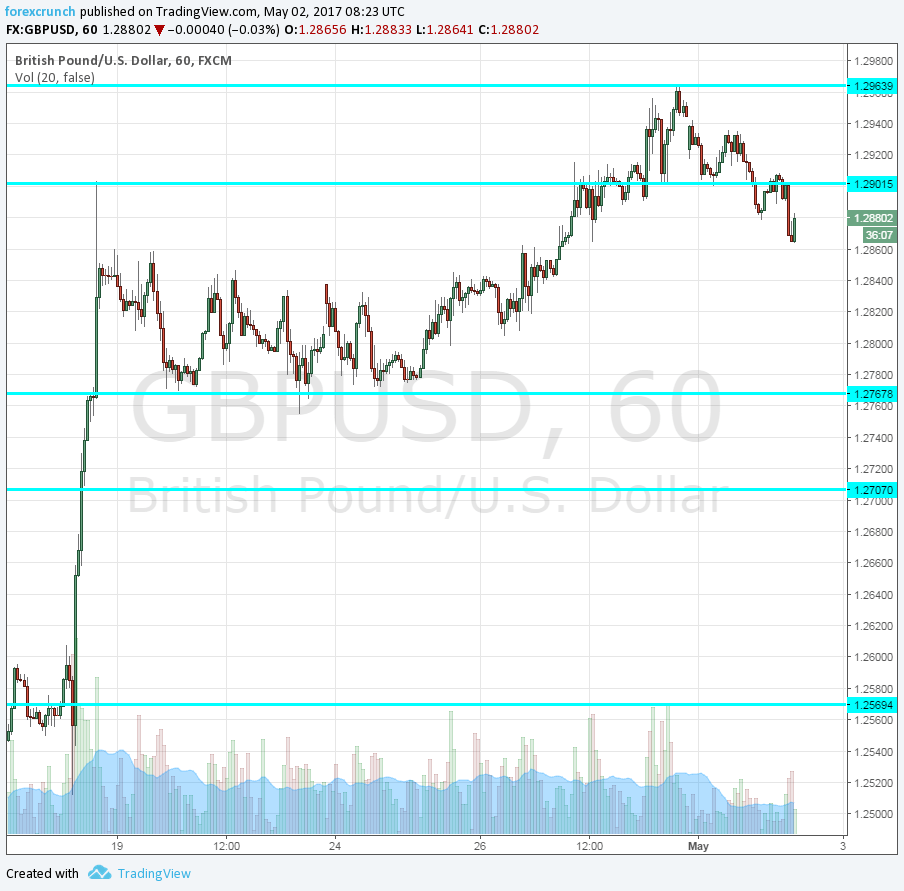

GBP/USD jumps above 1.29 and hit a session high of 1.2910. Further resistance awaits at 1.2965.

Markit’s purchasing managers’ index for the manufacturing sector was expected to tick down to 54 points in April, from 54.2 in March. Any score above 50 reflects expansion.

GBP/USD traded at the slightly lower ground ahead of the publication, around 1.2880. Cable reached a high of 1.2965 on Friday but slipped since then.

The pound has been hurt by reports that a meeting between European Commissioner Jean-Claude Juncker and UK Prime Minister Theresa May was a “disaster”. The Europeans are not so optimistic about reaching a good deal with Britain.

This is the first of three PMIs, with the services PMI on Thursday grabbing most of the attention. Nevertheless, manufacturing is still an important sector. After the EU Referendum, many had hoped that the weaker pound would boost this sector.

On Friday, we learned that the British economy significantly slowed down. The growth rate in Q1 2017 was 0.3%, around half of the initial post-Brexit levels. Year over year, GDP grew by 2.1%.

More: GBP: When Will The GBP Peak? Where To Target? – NAB

Here are the recent moves on the pound/dollar chart.