The UK services sector does not look good: 47.4 on the services PMI. The manufacturing PMI is also negative at 49.1 points. The composite index is at the worst in 7 years. The services sector and especially financial services, are critical for the UK economy. The fall in manufacturing could have been cushioned by the fall of the exchange rate which benefits exporters.

Brexit certainly has a negative impact on business confidence. This is not a total crash, but uncertainty is clearly at an extreme. Uncertainty means delaying decisions, and delaying decisions means less economic activity. The chances of a rate cut are now higher for the August 4th “Super Thursday”. The number for the services sector is clearly damp, and paints a darker picture than the BOE’s survey.

An alternative to a rate cut could be more QE from the current 375 billion pounds. In any case, the pressure is on Mark Carney and his colleagues to act. The Chancellor of the Exchequer Phillip Hammond also said the initial move should come from the monetary front.

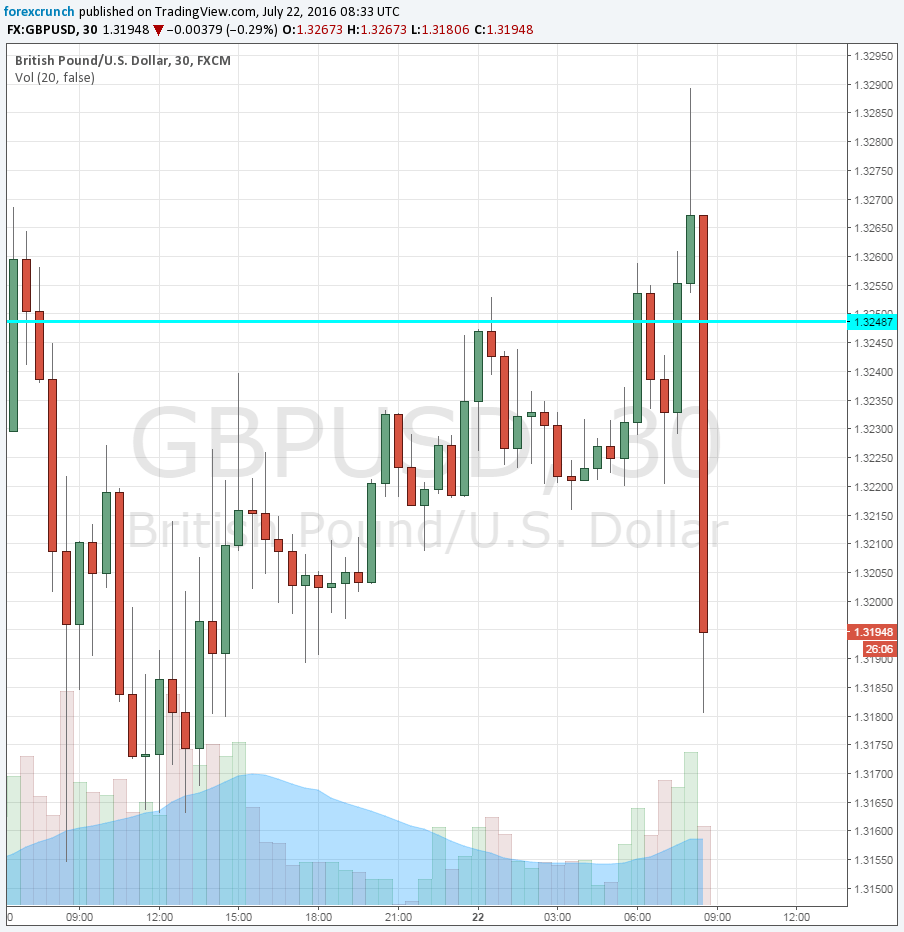

GBP/USD crashes some 80 pips under 1.32. The new low is 1.3172.

Expectations stood on minor contraction: just under 50 points for both figures.

Tension was high towards a special release by Markit: a one off preliminary publication of the UK’s purchasing managers’ indicators. The special release of both services and manufacturing PMIs is for the month of July, the first post-Brexit release. The unique issue was done in response to popular demand and consists of only 70% of the normal amount of data.

The big question is: How bad is Brexit? On one hand, we did see very worrying signs in the construction sector but on the other hand, the BOE’s report was not that terrible.

And speaking of the BOE, this will definitely feed into the August 4th decision. That is when the Bank will also publish its Quarterly Inflation Report. It also pre-announced stimulus in its previous meeting on July 14th, raising the tension.

Markit’s PMIs are highly regarded and always have a strong impact. This one is even more important.

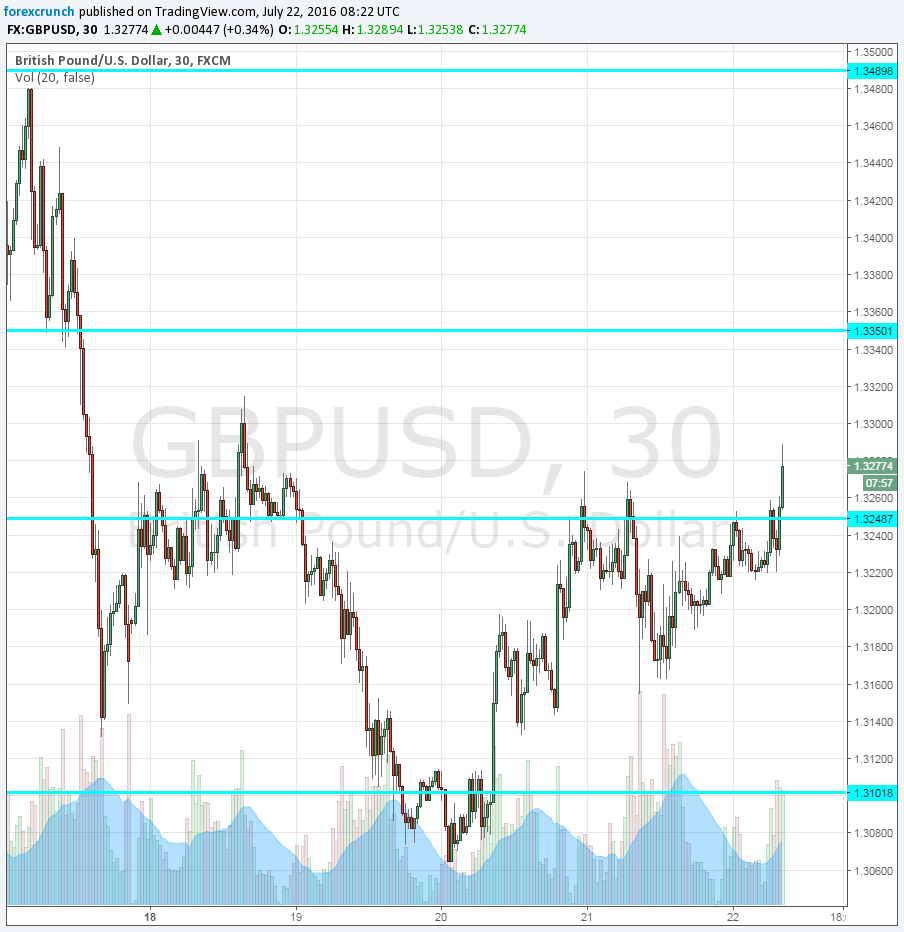

Before the announcement, GBP/USD was moving higher, trading at 1.3275. Resistance awaits at 1.3350 and 1.3480. Support is at 1.3120 and 1.30.

More: Sell GBP/USD – Morgan Stanley Trade Of The Week

We had a special video preview of the event: