- Economists expect to see the second month of recovery in British consumption in June.

- Year over year figures may serve as a reminder that expenditure remains depressed.

- GBP/USD has room to fall, also due to other headwinds.

Football is coming home – matches in England’s Premier League were resumed on June 1, potentially adding to the rebound in retail sales as the British economy gradually opened up. However, June was originally planned to feature Euro 2020, a much larger event.

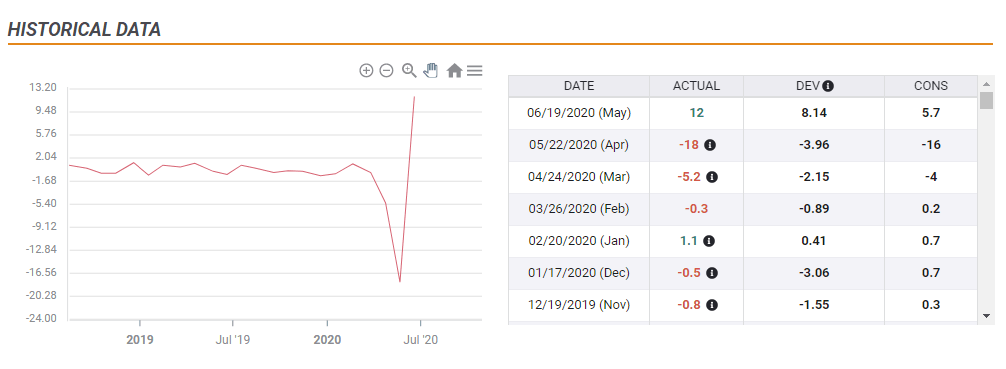

That is also the likely story of consumption – a significant bounce yet far below normal levels. The consensus of economists pointing to a leap of 8.5% in sales in June after 12% in May. The UK’s process of returning to normal, deferred expenditure from the lockdown days, and the immense furlough scheme make such expectations realistic.

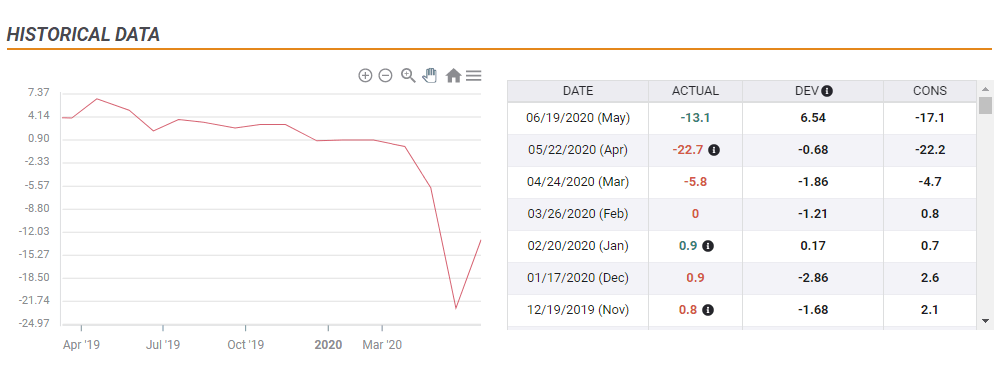

However, as the data shows, it follows a plunge of 17% in April and 5.2% in March. The year over year figures may provide a better view of where sales are in comparison to last year, which saw stable growth.

Projections stand at an improvement – albeit from a crash of 13.1% to -6.2% – a considerable gap.

The furlough scheme – in which the government pays to keep workers attached to their jobs – runs through October and will likely be extended. This massive economic support should provide confidence and push consumers to spend – encouraging investors to return to where they were last year.

Is that enough to boost the pound?

A significant upside surprise would send sterling higher and a considerable miss would trigger a downfall. What can traders expect if sales recover as expected?

High expectations imply the potential for disappointment and as mentioned earlier, the YoY figures may provide a reality check as well. Moreover, GBP/USD faces several headwinds that may slow any recovery, even if monthly consumption leaps.

1) Relations with China: The UK has suspended the extradition treaty with Hong Kong, in retaliation to China’s tighter grip on the former British colony. Beijing – already angered with London’d U-turn had vowed to retaliate ahead of the move related to HK. Without ties with the world’s second-largest economy, it would be hard for Britain to prosper in the post-Brexit world.

2) Brexit impasse: Talks between the EU and the UK are going nowhere fast. While both sides acknowledged that Brussels made concessions, the bloc says they were not reciprocated while London states they are insufficient. The lack of progress compounds worsening Sino-British relations.

3) US coronavirus cases: COVID-19 is raging in America, and that is keeping the safer-haven dollar bid. The greenback may ease early in the week, when figures from the weekend tend to show a better picture. However, UK retail sales are due out on Friday, after downbeat data is due and the dollar could be bid once again.

Conclusion

UK retail sales et to leap in June in comparison to May but remain depressed when looking at the same month in 2019. In case the figures largely meet expectations, GBP/USD has room to fall.