Brits are back to buying: a rise of 1.4% in headline sales in February, much better than expected. While this is accompanied by a downwards revision, we have a beat also on the y/y numbers” 3.7%. Excluding fuel, sales are up 1.3% m/m and 4.1% y/y. The rises now follow three consecutive months of drops in the headline m/m figure.

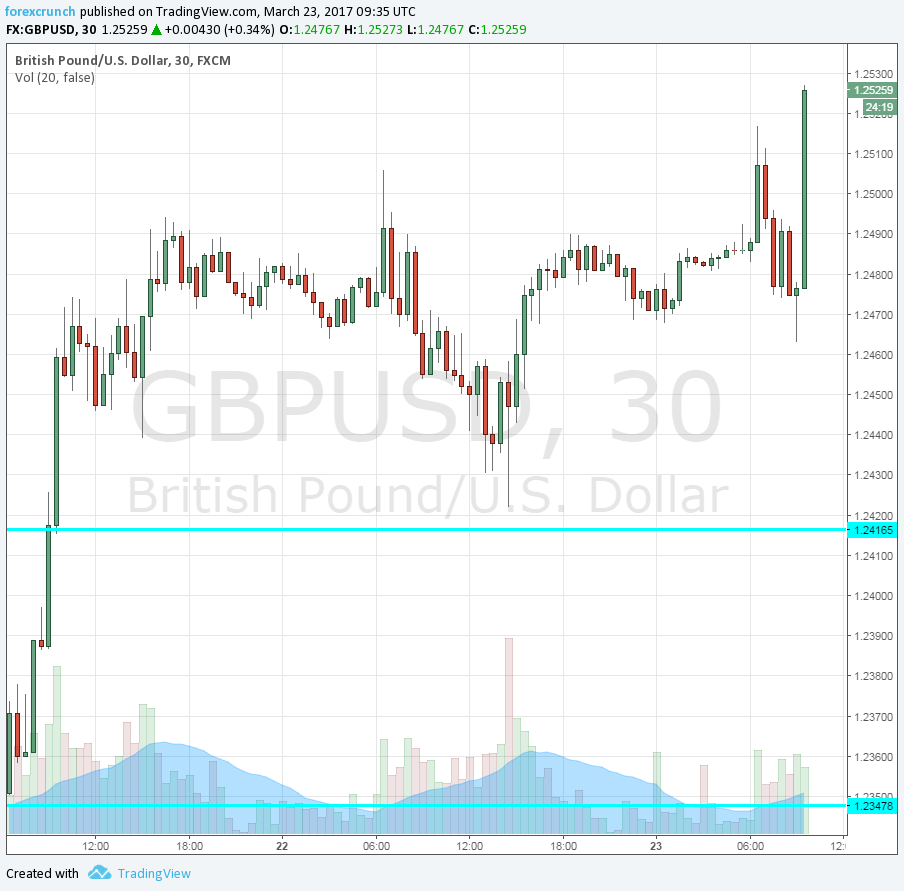

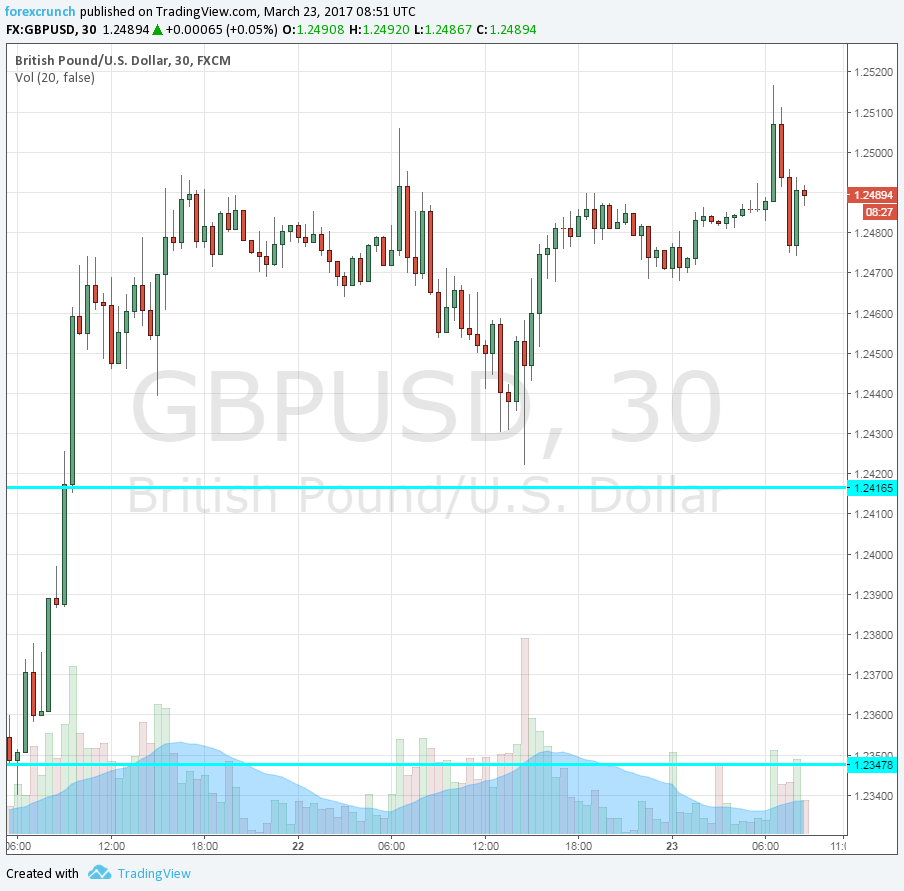

GBP/USD is jumping, topping 1.25. The high so far is 1.2527. The next level of resistance is at 1.2540. A further cap awaits at 1.2630. Support is at 1.2415.

Here is how it looks on the 30-minute chart:

The volume of retail sales was expected to rise by 0.4% m/m in February 2017, after a drop of 0.3% seen previously. Year over year, a rise of 2.6% was predicted to follow a 1.5% advance. Excluding fuel, estimates stood at 0.4% and 3.1% y/y.

GBP/USD was trading around 1.2380 ahead of the publication. The pound temporarily dropped after the initial reports about the terror attack in Westminster came out yesterday afternoon. However, while many were following the details of the high-profile atrocity, the pound recovered.

Back to the economics front, inflation is rising rapidly as we learned earlier this week. Headline CPI reached 2.3% y/y, mostly due to the weakness of the pound, a result of the Brexit vote. On the other hand, wage growth is slowing down, dropping to 2.2% in January.

The British government is set to officially trigger Article 50 on March 29th. This will start the clock ticking down to March 2019: a two-year window to negotiate a deal.

This means that real wages are not really growing, and this situation, consumers focus on essential products such as food and energy while refraining from spending on non-essentials.