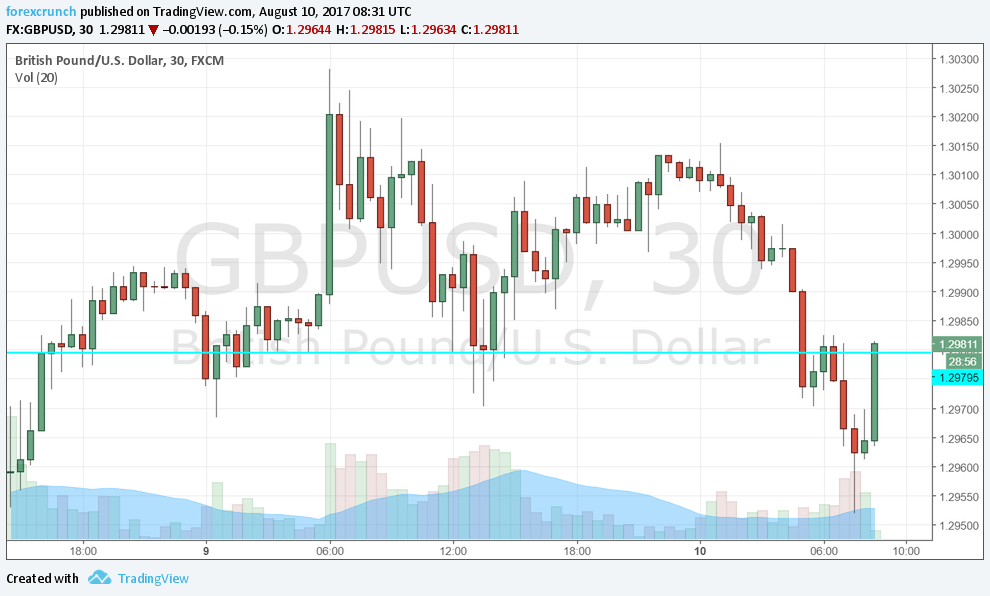

The pound was falling ahead of the release, reaching a low of 1.2954 at some point. Cable is now trading higher, around 1.2982. The round 1.30 level looms above.

The UK trade deficit widened to around 12.7 billion pounds, worse than 11 billion expected. On the other hand, manufacturing output remained flat as expected and the previous month saw an upwards revision to -0.1%.

The wider industrial output measure beat expectations with +0.5% and this uptick may have sparked the bounce back of the pair.

GBP/USD remains on the back foot. A combination of dollar strength and pound weakness has pushed the pair some 300 pips off the highs. The US dollar enjoyed a comeback after the robust jobs report on Friday. The gains were extended after a big beat on the JOLTs measure.

The pound’s weakness stems from the economic weakness seen this year and more recently from the BOE’s dovish tone at its recent meeting.

Support awaits at 1.2850 and 1.2720. Resistance is at 1.3050 and 1.3120.

More: GBP post-BOE – can it continue falling?

Here is the 30-minute chart showing the bounce in pound/dollar: