The UK’s Office for Budget Responsibility says that an estimated £58.7 billion will be needed on top of the £122 billion borrowing plans laid out by the new government last week.

The independent official budget watchdog said that Britain’s decision to leave the EU accounts for nearly half of the extra borrowing the nation will make over the next five-years and is expected to peak in 2018 – 2019.

The OBR’s forecast was the first official forecast on the costs related to leaving the EU during the June 23 referendum. Although the UK’s economy has managed to weather the consequences of leaving the EU, weaker business investment has already started showing signs.

OBR: UK growth expected to slow in 2017

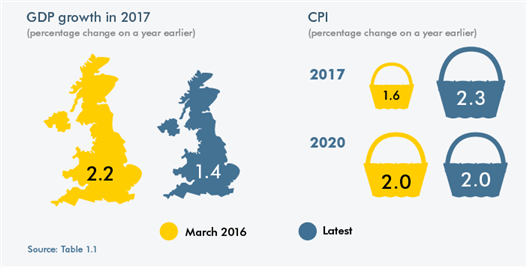

The OBR also released its growth forecasts where it expects UK’s growth to rise at a modest pace of 1.4% in 2017. This was a significant downgrade from its previous estimates of 2.2%, prior to the EU referendum verdict. Overall, OBR expects that Brexit would shave off 2.4 percentage points from the economic growth over the next five years.

UK Projected GDP and CPI, 2017 (Source: Officeforbudgetresponsibility.org.uk)

John Springford from the Center for European Reform said “In the long-term then, Brexit means lower spending or higher taxes. The key political question is who will be at the receiving end of these measures.” Springford said that lower income households would be the hardest hit on account of cuts to public service and welfare spending.

The OBR also estimates that inflation will rise steadily next year, projecting an annual inflation rate of 2.3% in 2017, up from its previous estimates of 1.6%. By 2020, inflation is expected to average at 2.0%

UK Autumn Budget Statement

On Thursday, the finance minister, Philip Hammond released his first autumn budget statement.

Calling the Brexit decision a vote that “will change the course of Britain’s history,” the chancellor said, “it’s a decision that also makes more urgent than ever the need to tackle our economy’s long-term weaknesses.”

In his speech, the Chancellor outlined his plans for boosting infrastructure spending to help the UK’s economy to sail through the Brexit waves. Hammond said that the UK would allocate

- £23 billion to a national productivity investment fund

- £2.3 billion towards housing infrastructure fund and

- £1 billion in digital infrastructure.

As part of the spending plans, Hammond said that government would no longer seek a budget surplus in 2019 – 2020. Debt is expected to rise from 84.2% of GDP in 2015 to 87.3% in 2016 and is expected to rise to 90.2% in 2017 – 2018.

The Office for Budget Responsibility estimates borrowing of:

- £68.2 billion in 2016,

- £59 billion in 2017/2018,

- £46.5 billion in 2018 – 2019 and

- £20.7 billion in 2020-2021

Income tax threshold was raised by £500 to £11,500 in April 2017 while the national living wage was lifted to £7.50, a slight improvement from the current £7.20. The OBR expects the UK’s labour market to add 500k jobs more over the forecast period.

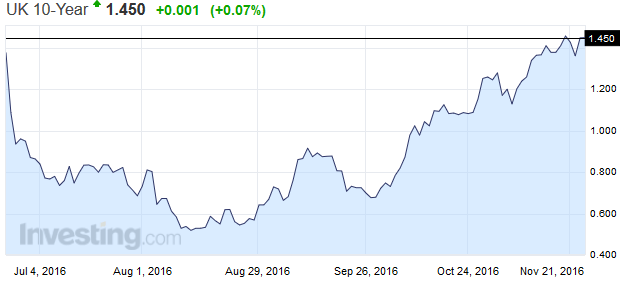

Following his speech, the British pound edged higher while the yields on the 10-year gilts closed at 1.449%, rising by 0.087 points. The Bank of England had previously ascertained that the risks were equally balanced on interest rate outlook. It marked a shift in the central bank’s narrative which was at one point poised to cut interest rates even lower from the current 0.25%. The Bank of England is likely to remain on the sidelines in the near term but could start looking at hiking interest rates by late Q1 2017 or by the second quarter next year, if inflation continues to advance towards the central bank’s 2.0% target rate.

UK 10-year yields steadily rising since August 2016

UK’s inflation rate fell to 0.9% in October 2016 after accelerating to 1% just the month before. However, despite the short term changes, the public expectations for inflation in the UK are reported to have risen at the fastest pace since 2011. A quarterly survey published by Barclays showed that inflation is expected to rise 2.2% in one year, up from 1.7% from its previous survey. The BoE expects inflation to hit 2.7% within the year.