A small beat on the UOM’s consumer confidence: 97.7 points. This seems to be fueled from the Expectations component which advanced to 88.1 points. Current Conditions are unchanged at 112.7. Inflation expectations advance from 2.5% to 2.6% for one year, but retreat from 2.4% to 2.3% for five years.

Will the dollar recover?

The University of Michigan’s preliminary consumer confidence measure for May 2017 was expected to remain unchanged at 97 points. The conditions component stood at 112.7 and the Expectations one at 87.

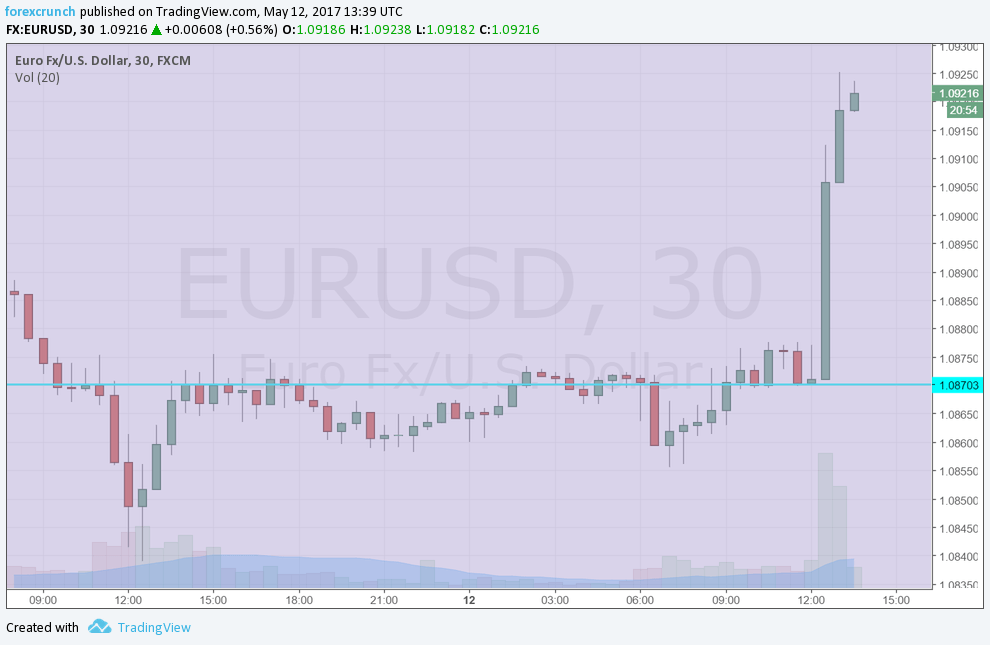

Earlier, inflation and reta\il sales data fell short of expectations and led to a downfall in the US dollar. While some misses in the retail sales report were countered by upwards revisions, the control group wasn’t. The control group is the core of the core. And speaking of core, core CPI dropped below 2% to 1.9% in the yearly measure.

There are now growing doubts about a rate hike in June. We already doubted it after the NFP. Chicago Fed President Charles Evans still sees inflation as further down the road.

The US political scene is dominated by the Comey affair. President Trump fired the FBI Director and was dogged by the aftermath. Markets were slightly worried that this might derail Trump’s growth agenda, but eventually, it was shrugged off.

More: EUR/USD volatility lowest since 2014 -; when will it wake up?