The US Conference Board Consumer Confidence measure made a huge leap to 125.6 points, far better than 114 that was expected. Also, the figure for February was revised up from 114.8 to 116.1 points.

The excellent news implies elevated consumption during the month of March. In theory, confident consumers spend more. The US economy is largely based on consumption.

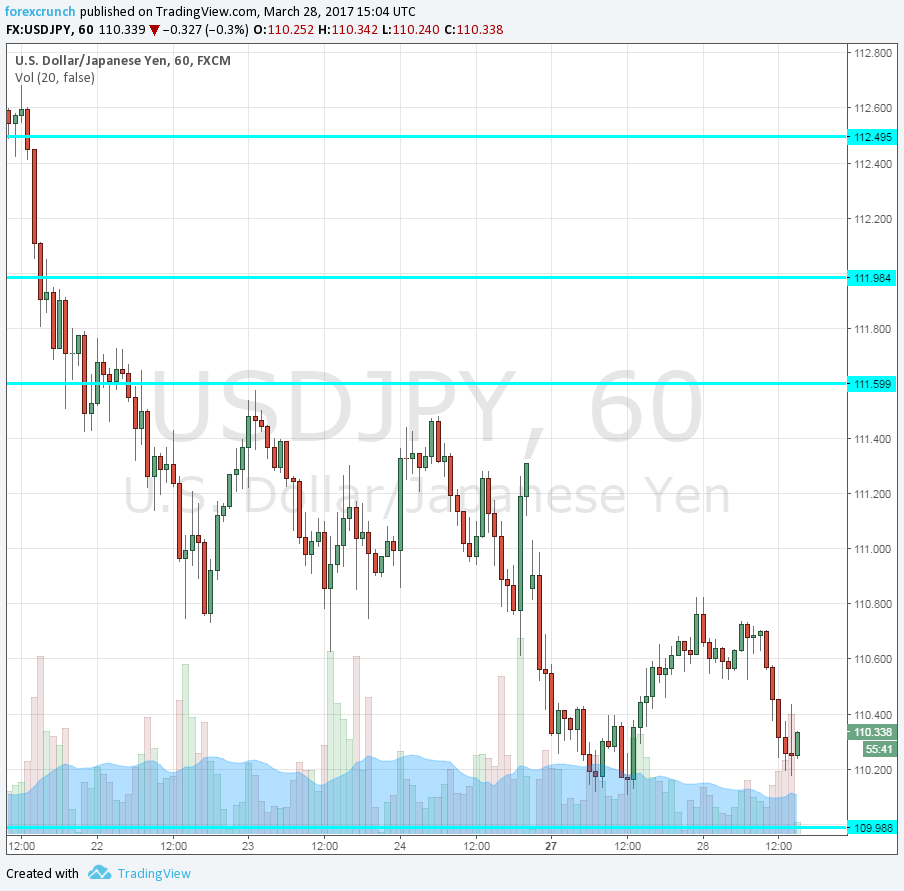

However, the US dollar remains under pressure. USD/JPY is still too close to the round number of 110. At 110.20, the pair is close to the lows seen yesterday.

Why is the dollar unconfident?

One explanation is the correlation between consumer figures and actual retail sales. It isn’t always there. Nevertheless, in past episodes, we have seen the dollar react positively to rises in confidence.

Yet a better explanation is the current bias against the US dollar. On the monetary front, the Fed brought forward its rate hike but did not alter its outlook. With no acceleration in the rate hike cycle, the greenback remains on the defensive.

Donald Disillusion

A bigger driver of the pair in recent months came from the political arena. Hopes that Trump would fulfill his promises regarding fiscal stimulus drove the dollar higher.

But also here, there is a growing disillusionment. The Trump administration decided to push healthcare reform before any tax cuts or infrastructure spending. And it failed.

The attempt to repeal and replace Obamacare exposed deep splits in the Republican Party. They have vowed to tear the ACA apart for seven years only to accept that it is “the law of the land” after two months of Trump in office.

And while Trump wants to move quickly to other topics, it is far from clear if he has the support there.

Conclusion – the dollar is weak

If a currency cannot rally on good news, it will break on any piece of slightly bad news. The dollar is exposed.

More: With the ugly DXY break, is the Trump trade over?