The dollar is unstoppable, and no, the Fed is NOT going to raise rates next week. They will probably express concern, and they have good reasons to do so. Nevertheless, the US dollar is king.

US consumers have not changed their mood in September, at least according to the initial data. Headline consumer sentiment remained at 89.8, slightly below 90.8 expected. The other components were mixed: current conditions are down from 107 to 103.5, against expectations for a rise. On the other hand, the Expectations component is up to 81.1 from 78.7, beating projections for a smaller rise.

The US dollar seems to hold onto its gains. The greenback was able to defy Brainard’s dovishness as well as poor retail sales numbers. And today, good news came from the inflation front: core inflation is up to 2.3% y/y and also headline inflation, less important for the Fed, is moving higher, from 1% to 1.1%. This positive news sent the dollar higher.

So, weak data means stability for the dollar, while good news means a stronger dollar.

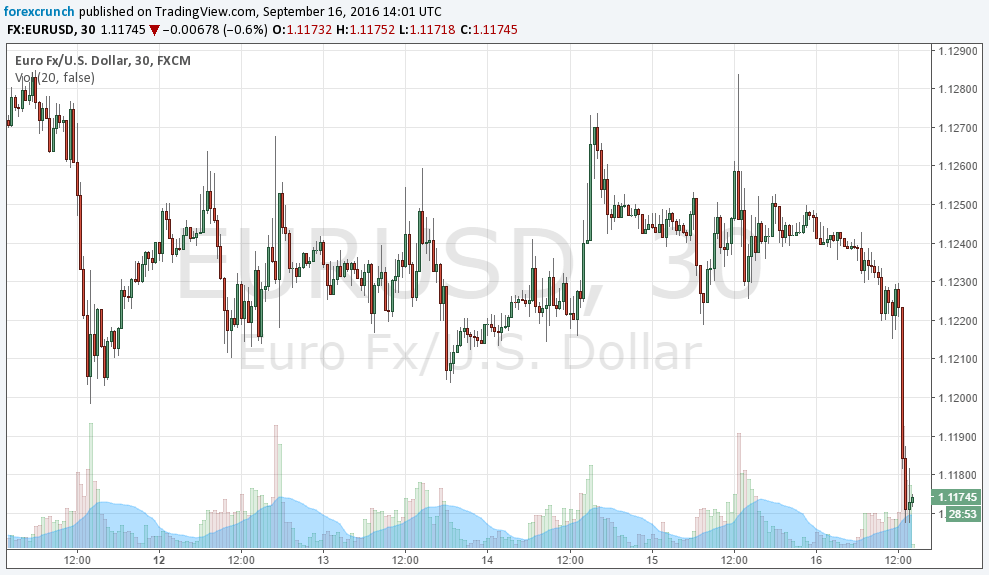

EUR/USD is currently trading at 1.1167, down below the 1.1190 level of support. The pair could not reach higher ground, failing to break 1.13. The next line of support is 1.1140, which is not that far away. Further below, 1.1050 and 1.0960 await.

The big event next week is the Fed decision. There are very low chances for a hike, yet the dollar remains the cleanest shirt in the dirty pile