Prices advanced 0.4% in April 2016 m/m, slightly better than 0.3% expected. The rest of the figures met expectations with year over year figures reaching 1.1%. Core inflation rose 0.2% m/m and 2.1%. While this is slightly lower than last 2.2% in March, it is bang on expectations. Housing data looks a bit more positive. Compared with other developed economies, inflation is OK in the US.

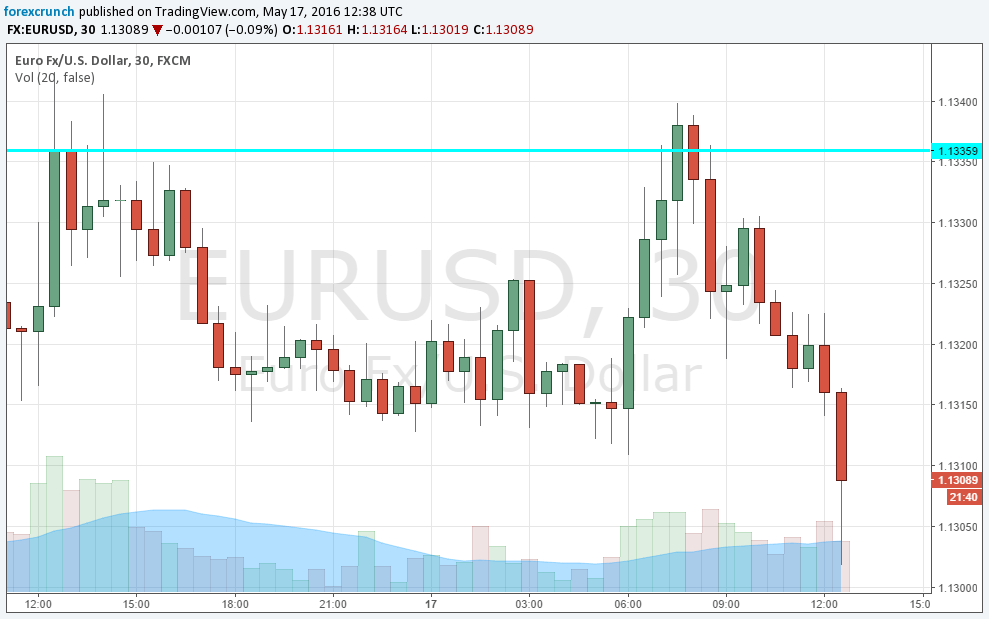

The US dollar is looking stronger with EUR/USD dipping under 1.13. USD/JPY stands out with an attempt to move above the triple top of 1.0950. Will the third try be a charm?

The Fed has two mandates: jobs and inflation. Regarding inflation, the focuses more closely on core inflation and even more specifically on the Core PCE Price Index – not this one. However, they move together in tandem.

Housing starts were a mixed bag but slightly positive in general: 1.172 million in housing starts (annualized), better than 1.127 expected and 1.099 seen last time (revised up). Building permits missed with 1.116 million against 1.13 expected, but also here, we had an upwards revisions. Starts rose 6.6% and permits 3.6%, so the general picture for the beginning of Q2 is positive.

We will get the industrial output numbers later on today.

Here is the slide of EUR/USD charted:

The greenback renewed its strength in a second wave of buying.