- The index failed to spark a rebound on US data.

- Yields of the US 10-year note move closer to 2.58%.

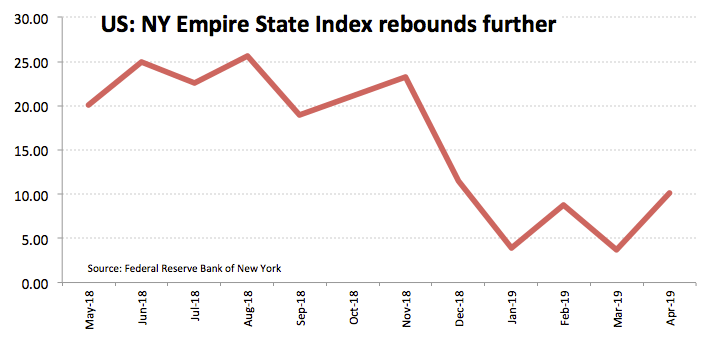

- NY Empire State index rose to 10.10 in April.

The greenback, in terms of the US Dollar Index (DXY), remains on the defensive around the 96.80 region despite auspicious US results.

US Dollar Index weak on risk appetite

The sentiment around the index remains depressed at the beginning of the week, with the buck adding to Friday’s losses in the 96.80 area despite the key NY Empire State index surprised markets to the upside rising to 10.10 for the current month.

In the broader picture, the greenback keeps facing headwinds stemming from investors’ preference for riskier assets amidst rising hopes of a US-China trade deal in the near term and somewhat easing jitters over Brexit and the slowdown in Euroland.

Later in the NA session, TIC Flows are due ahead of tomorrow’s Industrial Production figures, Capacity Utilization and the NAHB index.

What to look for around USD

DXY keeps tracking the broad risk appetite trends while headlines coming from the US-China/US-EU trade fronts also collaborate with the price action. The recent mixed views from the FOMC minutes reinforce the neutral stance of the Fed in the next months, although a rate raise has not been ruled out just yet. On the greenback’s positive side we find solid US fundamentals, its safe haven appeal, favourable yield spreads vs. its peers and the status of global reserve currency. This, plus the Fed’s neutral/bullish prospects of monetary policy vs. the dovish shift seen in its G10 peers are expected to keep occasional dips in the buck shallow for the time being.

US Dollar Index relevant levels

At the moment, the pair is losing 0.02% at 96.83 and faces immediate support at 96.75 (low Apr.12) seconded by 96.67 (55-day SMA) and finally 96.03 (200-day SMA). On the upside, a breakout of 97.09 (10-day SMA) would open the door to 97.52 (high Apr.2) and then 97.71 (2019 high Mar.7).