- The index bottomed out in sub-96.00 levels in early trade.

- Yields of the US 10-year note dropped to 2.63%.

- Another testimony by Chief Powell next of relevance.

After testing fresh 3-week lows in sub-96.00 levels late on Tuesday, the greenback managed to get some traction and retake the 96.00 barrier when tracked by the US Dollar Index (DXY).

US Dollar Index looks to data, Powell

The index continued to drift lower on Tuesday following the largely anticipated dovish message from Chief Powell at his testimony before the Senate Banking Panel.

In fact, Powell confirmed the more gradual approach adopted by the Federal Reserve at its latest meeting amidst rising uncertainty over the economic outlook, particularly stemming from China and Europe. Regarding the Fed’s plans to end the balance sheet runoff, Powell failed to shed further light on the subject.

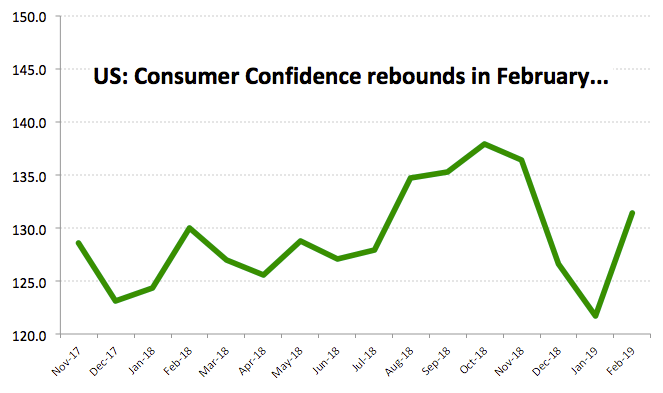

Later today, Powell will testify before the House Financial Services Committee, while Factory Orders, Trade Balance figures, Pending Home Sales and Durable Goods Orders are all due in the docket. Yesterday, Consumer Confidence gauged by the Conference Board rose above expectations to 131.4 for the month of February.

What to look for around USD

The US-China trade dispute remains in centre stage when comes to drive the global sentiment for the time being. In addition, all eyes will be on the Trump-Kim meeting today and tomorrow as a potential driver on the geopolitical side. The release of another estimate of the Q4 GDP (Thursday) will also give markets and idea of how the US economy fared in late 2018. Attention will also be on the second testimony by Fed’s Powell, although the tone should not be different from yesterday’s testimony.

US Dollar Index relevant levels

At the moment, the pair is gaining 0.11% at 96.14 facing the next hurdle at 96.40 (21-day SMA) followed by 96.55 (10-day SMA) and then 96.79 (23.6% Fibo of the September-December up move). On the flip side, a break below 95.95 (low Feb.26) would target 95.63 (200-day SMA) en route to 95.16 (low Jan.31).