- DXY rebounds further and reclaims 93.00 post-Payrolls.

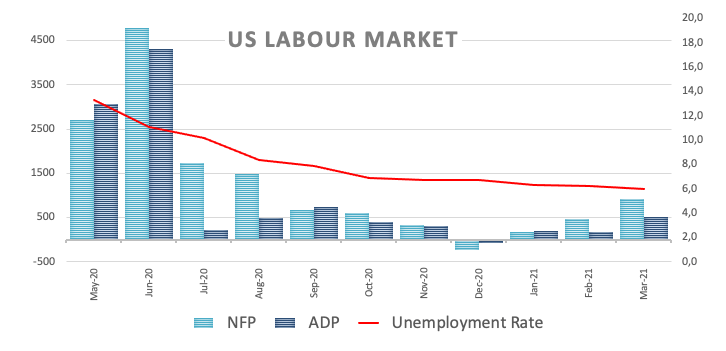

- The US economy added 916K jobs during last month.

- The jobless rate ticked lower to 6.0% (from 6.2%).

The US Dollar Index (DXY), which measures the buck vs. a bundle of its main competitors, manages to regain buying interest and flirt with 93.00 on Friday.

US Dollar Index stronger on Payrolls

The index moves higher and tests the 93.00 mark after the US economy created 916K jobs during March, surpassing consensus for a 647K gain. The February reading was revised to a creation of 468K (from 379K).

Further data showed the jobless rate eased to 6.0% and the critical Average Hourly Earnings – a proxy for inflation via wages – contracted 0.1% MoM and expanded 4.2% over the last twelve months. Another key gauge, the Participation Rate, improved a tad to 61.5% (from 61.4%).

What to look for around USD

The upside momentum in the dollar faltered ahead of the 93.50 region this week, sparking a corrective downside. Supporting the recent rally in the index, the breakout of the 200-day SMA seems to bolster the now constructive view on the buck, at least in the near-term. In addition, the recently approved fiscal stimulus package adds to the ongoing outperformance of the US economy narrative as well as the investors’ perception of higher inflation in the next months, all morphing into extra oxygen for the buck. However, the mega-accommodative stance from the Fed (until “substantial further progress” in inflation and employment is made) and hopes of a strong global economic recovery (now postponed to later in the year) remain a source of support for the risk complex and carry the potential to curtail the upside momentum in the dollar in the longer run.

Eminent issues on the back boiler: Biden’s new stimulus bill worth around $3 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating? Future of the Republican party post-Trump acquittal.

US Dollar Index relevant levels

At the moment, the index is gaining 0.05% at 92.97 and faces the next support at 92.45 (200-day SMA) followed by 91.30 (weekly low Mar.18) and then 91.05 (100-day SMA). On the other hand, a break above 93.43 (2021 high Mar.31) would expose 94.00 (round level) and finally 94.30 (monthly high Nov.4).