- DXY pushes higher and approaches the 91.00 mark.

- Broad-based cautious trading bolsters the demand for the dollar.

- US markets are closed on Monday due to the Martin Luther King holiday.

The greenback, when measured by the US Dollar Index (DXY), adds to Friday’s gains and moves closer to the key barrier at 91.00 the figure, or new 2021 highs.

US Dollar Index focused on politics, risk aversion

The index advances for the second session in a row at the beginning of the week, always on the back of the persistent offered tone in the risk complex.

In fact, the risk aversion mood stays unchanged on Monday despite auspicious results from the Chinese economy released in early trade. Those results showed China’s economy expanded 2.6% QoQ in the October-December period and 6.5% on an annualized basis. Further data showed the Industrial Production expanded 7.3% in December from a year earlier, while Retail Sales gained 4.6% YoY.

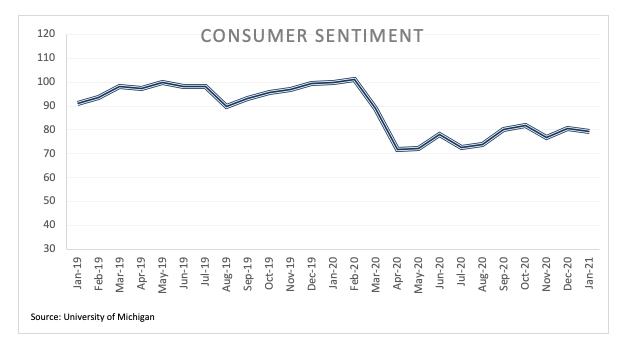

The risk-off sentiment also derives extra support after the mixed results from the US docket last Friday, when Retail Sales and the flash Consumer Sentiment gauge came in well short of estimates.

In the meantime, liquidity conditions are expected to remain marginal due to the MLK holiday in the US. Moving forward, and in the US political scenario, Joe Biden will be appointed the 46th US President on Wednesday.

What to look for around USD

The index regained buying interest after bottoming out in the 89.20 area in the first trading week of the new year and now manages to advance to the vicinity of 91.00 so far on Monday, clinching at the same time new yearly peaks. The recovery in US yields keeps lending support to the greenback as investors continue to perceive a potential pick-up in inflation pressure/expectations in response to the most likely increment in fiscal stimulus under a Democrat White House. However, the outlook for the greenback remains fragile in the short/medium-term for the time being amidst massive monetary/fiscal stimulus in the US economy, the “lower for longer” stance from the Federal Reserve and prospects of a strong recovery in the global economy.

US Dollar Index relevant levels

At the moment, the index is gaining 0.18% at 90.88 and a breakout of 91.01 (weekly high Dec.21) would open the door to 91.15 (55-day SMA) and finally 92.46 (23.6% Fibo of the 2020-2021 drop). On the other hand, immediate contention emerges at 89.20 (2021 low Jan.6) followed by 88.94 (monthly low March 2018) and the 88.25 (monthly low February 2018).