- The index exchanges gains with losses near 97.40.

- Yields of the US 10-year note ease from tops beyond 2.61%.

- March’s Existing Home Sales next on the docket.

The greenback is attempting a sideline patter in the upper end of the recent range in the 96.40/50 band when tracked by the US Dollar Index (DXY).

US Dollar Index bolstered by data

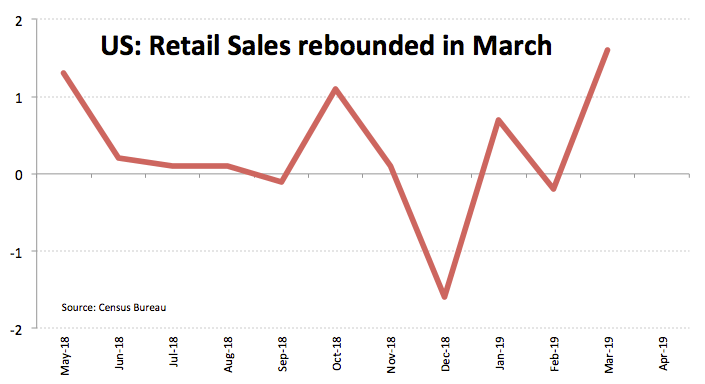

The index moved to fresh tops in the boundaries of 97.50 in the second half of last week, mainly boosted by solid prints from Retail Sales for the month of March despite the Philly Fed index failed to meet consensus this month. In fact, headline sales expanded at a monthly 1.6% while the core reading also gained 1.2% MoM, both prints surprising markets to the upside.

Also adding to USD-buying, April’s preliminary figures from manufacturing PMIs in core Euroland disappointed expectations last week, dragging EUR/USD to fresh weekly lows in the 1.1230/25 band.

In the meantime, DXY appears mostly unchanged near recent tops following the Asian session, all amidst thin trading conditions due to the expected inactivity in many markets in the Old Continent on Easter Monday.

In the US docket, Existing Home Sales during March will be the sole publication later today.

What to look for around USD

The upbeat momentum in the buck appears sustained by solid prints in the domestic docket as of late in combination with weakness from overseas data, mostly from Euroland and lack of fresh headlines from the US-China trade front. The recent mixed views from the FOMC minutes reinforce the neutral stance of the Fed in the next months, although a rate raise has not been ruled out just yet. On the greenback’s positive side we find solid US fundamentals, its safe haven appeal, favourable yield spreads vs. its peers and the status of global reserve currency. This, plus the Fed’s current neutral/bullish prospects of monetary policy vs. the dovish shift seen in its G10 peers is expected to keep occasional dips in the buck shallow for the time being.

US Dollar Index relevant levels

At the moment, the pair is gaining 0.01% at 97.40 and faces the next hurdle at 97.49 (high Apr.18) seconded by 97.52 (high Apr.2) and then 97.71 (2019 high Mar.7). On the other hand, a breach of 97.11 (21-day SMA) would aim for 96.75 (low Apr.12) and finally 96.06 (200-day SMA).