- DXY is down smalls, still close to YTD peaks.

- US markets are closed on Monday due to Washington’s Birthday.

- FOMC minutes, Philly Fed index, flash PMIs due later in the week.

The greenback, when tracked by the US Dollar Index (DXY), seems to have met strong resistance in the area of yearly tops around 99.20.

US Dollar Index looks to China, data

The index is giving away part of the recent advance to new multi-month peaks in the 99.15/20 band at the beginning of the week.

In fact, the buck’s rally appears to be taking a breather on Monday amidst no fresh news around the COVID-19, alternating risk appetite trends and the absence of activity in the US markets due to the Washington’s Birthday holiday.

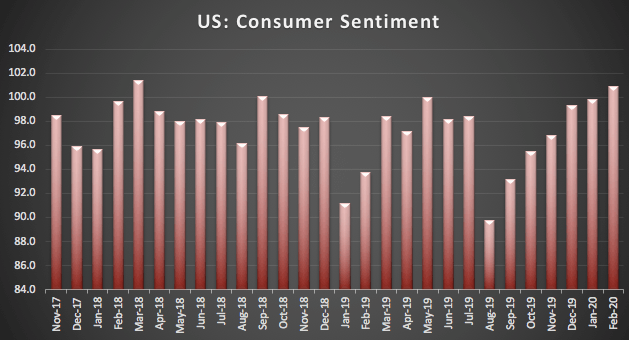

February’s positive momentum around the greenback has been sustained so far by, in general, better-than-expected results in domestic fundamentals as well as persistent weakness in some of its rivals and safe haven demand on the back of increasing reported cases of the Wuhan coronavirus.

Later in the week, the FOMC minutes (Wednesday) will be the salient event, seconded by the Philly Fed manufacturing gauge (Thursday) and advanced Markit’s PMIs for the month of February (Friday).

What to look for around USD

The index has extended the march north to the vicinity of 99.20 mark, clinching at the same time new 2020 tops. Investors should now keep looking to the performance of US fundamentals and the broader risk appetite trends for direction as well as any fresh developments from the COVID-19. In the meantime, the outlook on the dollar remains constructive and bolstered by the current “appropriate” monetary stance from the Fed vs. the broad-based dovish view from its G10 peers, the “good shape” of the domestic economy, the buck’s safe haven appeal and its status of “global reserve currency”.

US Dollar Index relevant levels

At the moment, the index is losing 0.05% at 99.11 and faces initial support at 98.75 (23.6% Fibo retracement of the February rally) seconded by 98.54 (monthly high Nov.29 2019) and then 98.22 (21-day SMA). On the other hand, a breakout of 99.17 (2020 high Feb.14) would aim for 99.37 (high Sep.3 2019) and finally 99.67 (2019 high Oct.1).