- The index loses upside traction near 97.30.

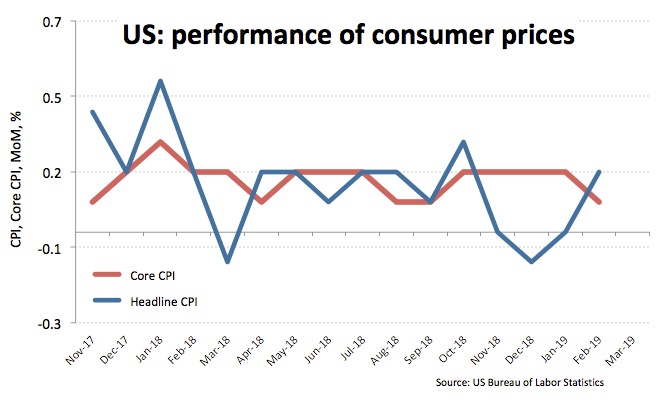

- US headline consumer prices rose 0.2% MoM in February.

- Attention remains on the Brexit vote later in the day.

The greenback, in terms of the US Dollar Index (DXY), clings to its daily gains around the 97.00 despite the mixed results from the US calendar.

US Dollar Index gave away gains on US data

Investors have quickly reverted the bullish attempt in DXY to the proximity of 97.30 following unconvincing results from US inflation figures during last month.

In fact, headline CPI rose 0.2% on a monthly basis and 1.5% from a year earlier, while Core prices rose 0.1% MoM and 2.1% over the last twelve months. Still in the US docket but earlier in the session, the NFIB index came in at 101.7 for the month of February, a tad lower than expectations albeit higher than January’s reading.

In the meantime, the greenback managed to revert part of the initial weakness as the risk-on sentiment appears somewhat mitigated ahead of the crucial Brexit vote later in the European evening.

What to look for around USD

The optimism around a positive outcome in the US-China trade front appears somewhat mitigated as of late, while there is no further news on the supposed meeting between Trump and Xi later in the month. Despite Payrolls were a fiasco when comes to job creation during last month, the lower jobless rate and auspicious prints from wage inflation could support the buck on occasional drops somehow. Investors, in the meantime, continue to scrutinize the probable change in the Fed’s rate path as well as any re-assessment of the ongoing QT.

US Dollar Index relevant levels

At the moment, the pair is gaining 0.10% at 97.04 and a break above at 97.71 (2019 high Mar.7) would open the door to 97.87 (monthly high Jun.20 2017) and finally 99.89 (monthly high May 11 2017). On the flip side, the next support lines up at 96.92 (low Mar.11) seconded by 96.33 (55-day SMA) and then 95.82 (low Feb.28).