- The index moves higher near 96.70, daily highs.

- US 10-year yields recede from tops above 2.45%.

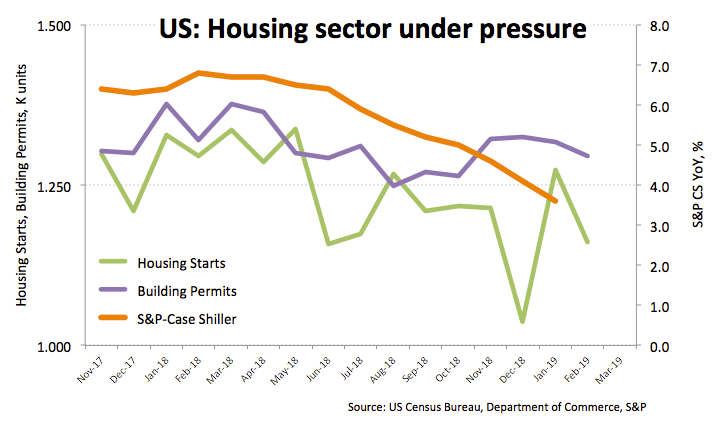

- US Housing Starts, Building Permits came in below estimates.

The greenback has reversed the initial pessimism and is now trading in daily highs beyond 96.70 when measured by the US Dollar Index (DXY).

US Dollar Index bid despite poor data

The index has quickly picked up pace and managed to clinch tops in the 96.70/75 band in spite of poor results from the US housing sector and mainly following the selling pressure in EUR.

In fact, Housing Starts contracted to 1.162M units during February, or 8.7%, while Building Permits shrunk to 1.296M units in the same period, or 1.6%. In the same line, house prices measured by the S&P/Case-Shiller Index rose at a non-seasonally-adjusted 3.6% on a year to January, missing consensus.

Looking ahead, the Conference Board will publish its Consumer Confidence gauge for the current month ahead of the weekly report on US crude oil supplies by the American Petroleum Institute.

What to look for around USD

The greenback stays under the microscope for the time being while market participants continue to adjust to the prospects of no hikes from the Fed this year and just one rate raise in 2020. Further attention falls on the inversion of the US yield curve, which is seen as a prologue for a probable recession in a year’s time-ish. On the supportive side, the buck could gather some traction in case of souring risk appetite and widening rate differentials vs. its peers. From the political view, the debt ceiling, the border-wall funding and upcoming elections next year carry the potential to spark bouts of extra volatility around USD.

US Dollar Index relevant levels

At the moment, the pair is gaining 0.17% at 96.68 and a breakout of 96.81 (high Mar.22) would expose 97.37 (high Feb.15) and finally 97.71 (2019 high Mar.7). On the other hand, the immediate support lines up at 95.74 (low Mar.20) followed by 95.16 (low Jan.31) and then 95.03 (2019 low Jan.10).