- DXY adds to Thursday’s gains and retakes the 91.80 area.

- Higher US yields lend support to the dollar on Friday.

- US Consumer Sentiment, housing data next on the calendar.

The US Dollar Index (DXY), which gauges the greenback vs. a bundle of its main rivals, manages to regain some buying interest and navigates the 91.80 zone at the end of the week.

US Dollar Index looks to yields, data

The index adds to Thursday’s gains and pushes higher to re-test the 91.80/85 band following recent multi-week lows in the mid-91.00s.

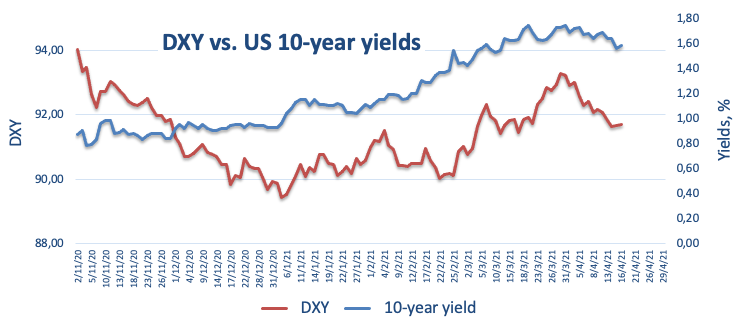

The renewed upside in the buck comes amidst the recovery in yields of the key US 10-year note, which dropped to levels last seen in early March around 1.52% on Thursday and now navigate near the 1.58% level.

In the meantime, the dollar struggles to find upside traction so far this month despite solid results from domestic fundamentals (weekly claims, regional manufacturing gauges and retail sales), as investors look to have already priced in the outperformance of the US economy vs. the rest of its DM peers amidst the improved pace of the vaccine rollout overseas.

Later in the US docket, the advanced Consumer Sentiment gauge for the month of April is due seconded by Housing Starts and Building Permits figures recorded during last month.

What to look for around USD

The dollar seems to have met decent contention around the 91.50 area so far amidst ] the retracement in US yields and the loss of enthusiasm on the US reflation/vaccine trade. Also weighing on the buck emerges the mega-accommodative stance from the Fed (until “substantial further progress” in inflation and employment is made) and hopes of a strong global economic recovery, all morphing into a source of support for the risk complex and a likely driver of probable weakness in the dollar in the second half of the year.

Key events in the US this week: Housing Starts, Building Permits, advanced Consumer Sentiment (Friday).

Eminent issues on the back boiler: Biden’s new stimulus bill worth around $3 trillion. US-China trade conflict under the Biden’s administration. Tapering speculation vs. economic recovery. US real interest rates vs. Europe. Could US fiscal stimulus lead to overheating? Future of the Republican party post-Trump acquittal.

US Dollar Index relevant levels

At the moment, the index is gaining 0.07% at 91.73 and a break above 92.21 (200-day SMA) would open the door to 93.43 (2021 high Mar.31) and finally 94.30 (monthly high Nov.4). On the downside, the next support is located at 91.49 (monthly low Apr.15) followed by 91.30 (weekly low Mar.18) and then 91.04 (100-day SMA).