- The index navigates the 97.20/30 band, a tad below recent highs.

- Yields of the US 10-year note slip back to the 2.01% area.

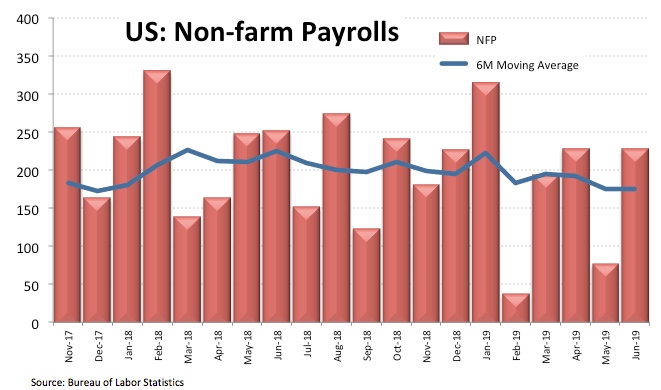

- Markets are still digesting the recent Payrolls figures (224K).

The greenback, in terms of the US Dollar Index (DXY), is alternating gains with losses at the beginning of the week around the 97.30 area.

US Dollar Index looks to data, Powell, FOMC

The index is looking to add to recent gains following two consecutive weekly advances, moving further north of 97.00 the figure and recording the best weekly performance since last August (+1.2%).

Auspicious results from US Payrolls during June (224K) mitigated market speculations of a 50 bps rate cut at the Fed’s meeting later this month despite a 25 bps cut is nearly fully priced in.

There are no data releases in the US docket later today, while all the attention will be on inflation figures, Powell’s testimony and the FOMC minutes, all due later in the week.

What to look for around USD

The solid print from June’s Payrolls added extra wings to the positive performance of the greenback in the last couple of weeks, exacerbated by the breakout of the critical 200-day SMA and the multi-month resistance line, all in the 96.60 region. This week, all eyes will be on Chief Powell’s testimony and the FOMC minutes (both events on Wednesday) against the backdrop of now shrinking speculations of a rate cut in the very near term. DXY, in the meantime, appears supported by rising yields, solid fundamentals – despite the lack of sustainable upside traction in inflation – the safe have appeal of the buck and its status of ‘global reserve currency’; while deceleration in overseas economies and the shift to a more accommodative stance from Fed’s peers also collaborate with the upbeat mood in USD. On the negative side, it will be interesting to gauge the impact (if any at all) of President Trump’s criticism to the Fed’s policy on the views of the Committee. In addition, swelling scepticism around the resumption of the US-China trade talks could also hamper further gains.

US Dollar Index relevant levels

At the moment, the pair is gaining 0.02% at 97.19 and faces the next up barrier at 97.44 (monthly high Jul.5) seconded by 97.77 (high Jun.18) and finally 98.37 (2019 high May 23). On the downside, a breakdown of 96.66 (200-day SMA) would aim for 95.82 (low Feb.28) and then 95.74 (low Mar.20).