- The index loses upside momentum post-data.

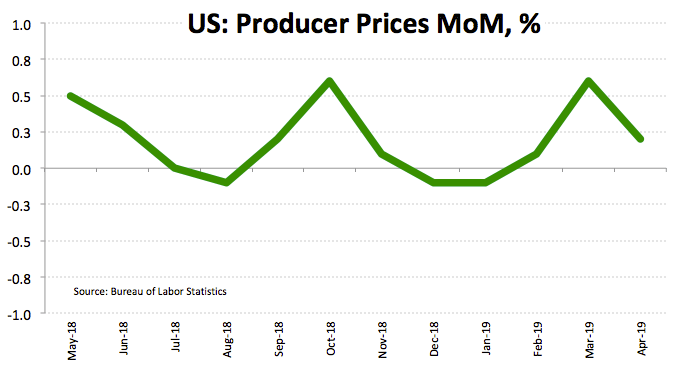

- US Producer Prices rose 0.2% MoM in April.

- US-China trade talks in the limelight today and Friday.

The greenback is now correcting lower, easing some ground after climbing as high as the 97.70 region, or daily highs, when gauged by the US Dollar Index (DXY).

US Dollar Index focused on trade, Fedspeak

The index has now come under some selling pressure after US Producer Prices failed to surprise markets today, rising at an expected 0.2% inter-month during April (from 0.6%) and 2.2% from a year earlier.

In the meantime, investors keep the cautious tone unchanged in light of the resumption of US-China trade talks in Washington later today and tomorrow. On Friday, however, the White House is expected to increase the tariffs of US imports of Chinese goods to 25% from the current 10%.

More from the US docket saw Initial Claims rising at a weekly 228K, missing consensus and taking the 4-Week Average to 220.25K from 212.50K. The trade deficit widened a tad to $50.0 billion during March (from $49.3 billion).

Later in the NA session, Chicago Fed C.Evans (voter, dovish) will speak at the Fed Community Development Conference while Atlanta Fed R.Bostic (2021 voter, centrist) is expected to discuss on the Economic Outlook.

What to look for around USD

The centre of the debate for the greenback has shifted to the US-China trade dispute, although a high degree of uncertainty as well as scepticism among investors seem to prevail for the time being. On another direction, the lack of traction in US inflation – and concerns among Fed members – currently challenges the continuation of the recent up move in DXY. Dips in the buck, however, are seen shallow as overseas weakness, the safe haven appeal, favourable yield spreads vs. the Fed’s G10 peers and the status of global reserve currency keep the constructive bias on the buck unchanged.

US Dollar Index relevant levels

At the moment, the pair is losing 0.02% at 97.57 and a breach of 97.15 (low May 1) would aim for 97.06 (55-day SMA) and finally 96.75 (low Apr.12). On the other hand, the next hurdle aligns at 98.10 (high May 3) seconded by 98.32 (2019 high Apr.25) and then 99.89 (high May 11 2017).