- DXY resumes the upside following Tuesday’s negative close.

- The continuation of the uptrend is expected to meet 91.00.

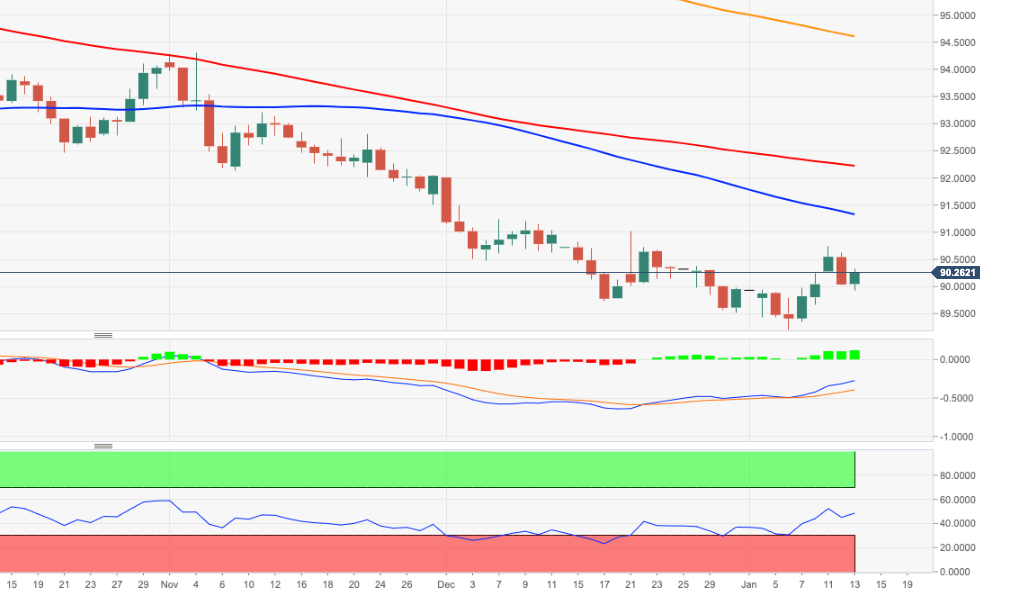

After bottoming out in fresh lows near 89.20 earlier in the new year, the dollar managed to regain moderate buying attention and extended the move to the vicinity of 90.70 earlier in the week.

If the bullish attempt becomes more sustainable, then there is the chance of a move to the weekly high in the 91.00 region (December 21). Above this level, the prevailing downside pressure is expected to mitigate somewhat.

In the longer run, as long as DXY trades below the 200-day SMA, today at 94.59, the negative view is forecast to prevail.

DXY daily chart