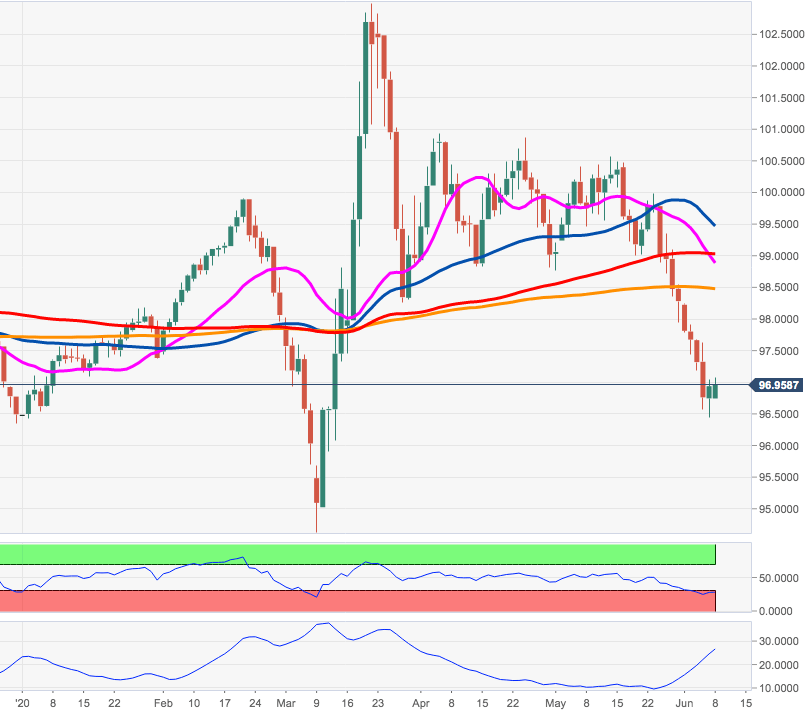

- DXY has reclaimed some ground lost and flirts with 97.00.

- Further south now emerges the Fibo retracement at 96.03.

The sharp sell-off in DXY met contention in the mid-96.00s for the time being.

Despite the current oversold conditions (as per the daily RSI), the dollar remains under heavy pressure and faces the prospects of deeper pullbacks in the short-term horizon.

If the index breaks below the key 2019-2020 support line on a sustainable fashion, this could lead to a potential visit to the 96.00 neighbourhood, where sits a Fibo retracement of the 2017-2018 drop.

DXY daily chart