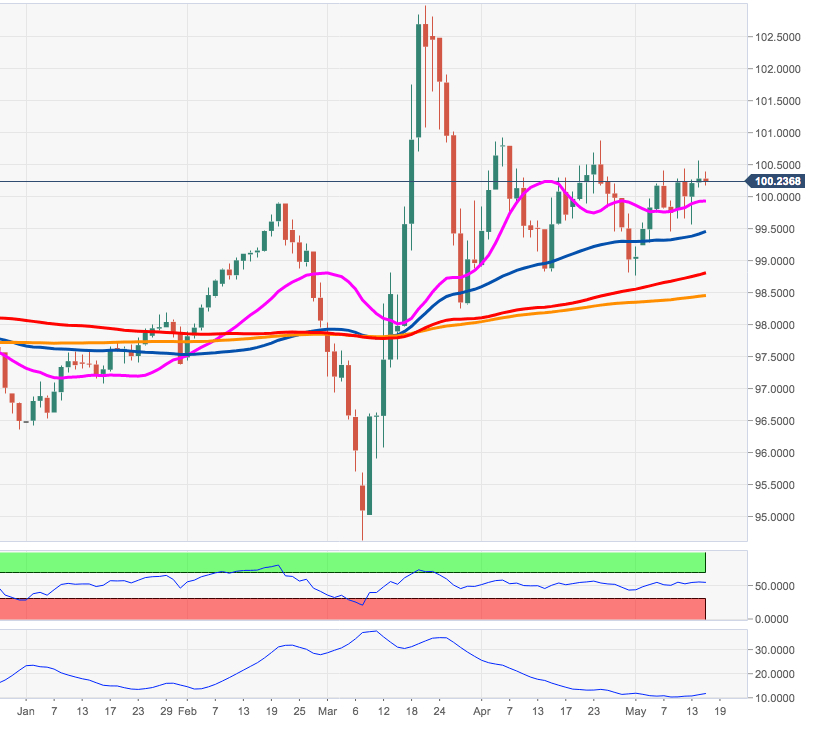

- DXY keeps consolidating the breakout of the 100.00 mark.

- A surpass of 100.56 should put 101.00 back on the radar.

DXY keeps navigating the upper end of the monthly range above the 100.00 mark and approaches the tough barrier in the 100.50 area, where converge May tops and a Fibo retracement (of the 2017-2018 drop).

A clear breakout of this key hurdle is expected to pave the way for another visit to the April peaks in the 101.00 neighbourhood.

On the broader picture, the 200-day SMA – today at 98.43 – continues to underpin the constructive outlook in the dollar for the time being.

DXY daily chart