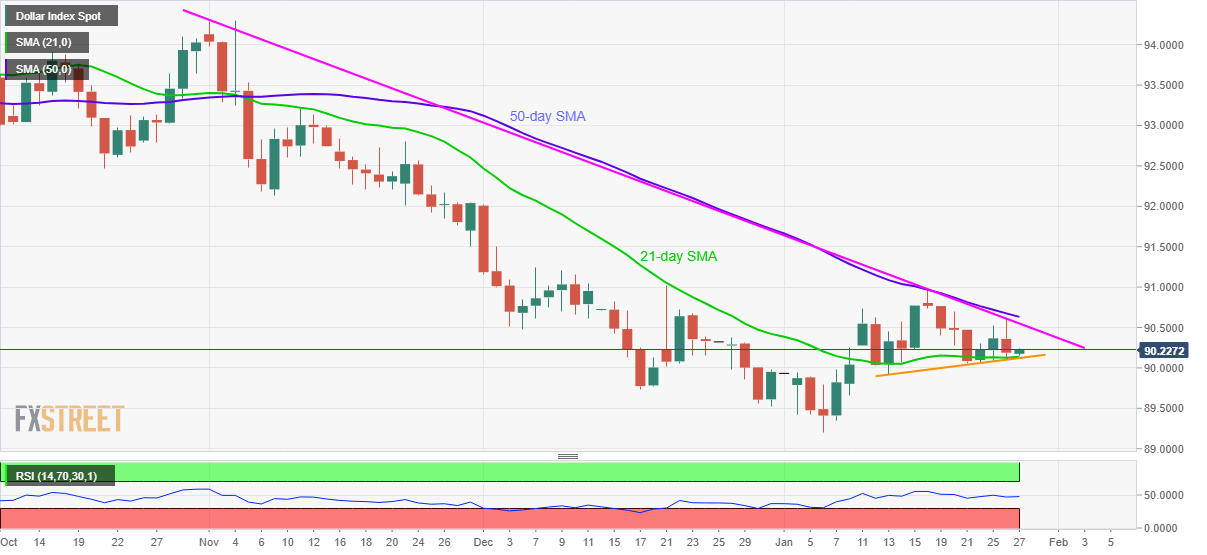

- DXY picks up bids following its bounce off two-week-old support line, 21-day SMA.

- 12-week-old resistance line, 50-day SMA guard immediate upside.

- RSI conditions suggest continuation of sideways moves.

- Fed expected to unveil dovish halt during the first FOMC of 2021.

US dollar index (DXY) extends recovery moves while picking up the bids to 90.22 during early Wednesday. The greenback gauge stepped back from a downward sloping trend line from November 02 the previous day. Though, 21-day SMA and a short-term ascending support line restricted further declines.

Although the latest bounce off key support confluence, coupled with the normal RSI line, favor the extension of the corrective pullback, the key resistance line and 50-day SMA challenge the DXY bulls.

As a result, the quote’s current upside momentum eyeing the stated resistance line, at 90.54 now, may fade if fail to cross the 50-day SMA level of 90.65.

On the contrary, the fresh downside will have to break below the 90.13 support confluence and 90.00 round-figure to recall the US dollar bears.

While RSI seems to be failing to provide any clear direction, DXY moves are likely to take clues from today’s US Federal Open Market Committee (FOMC) meeting. Should the Fed announce a dovish halt, as expected, the quote is likely to break the key support while an upbeat statement from the US central bank, if any, needs validation from stimulus and vaccine headlines to please the bulls.

Read: Fed Preview: Fearing market froth or boosting Biden’s stimulus? Three scenarios

DXY daily chart

Trend: Sideways