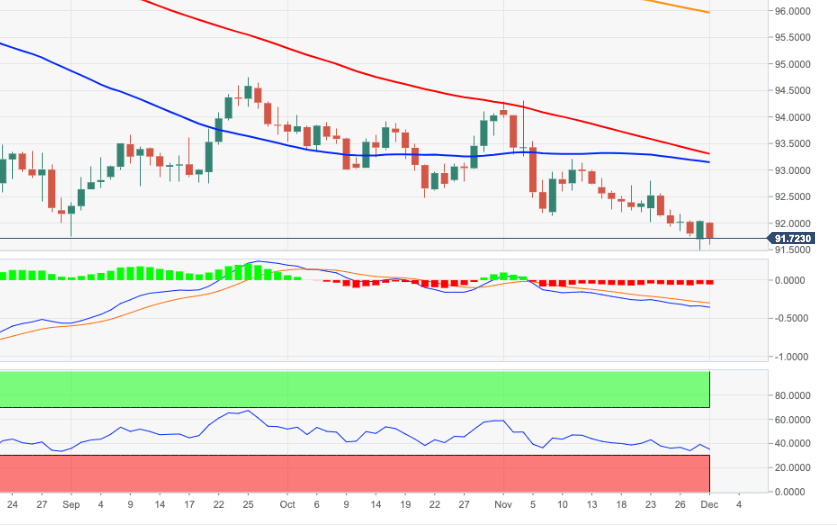

- DXY gyrates around the 8-month support line near 91.70.

- The index recorded new 2020 lows in the 91.50 zone on Monday.

The bearish momentum surrounding the greenback remains unchanged and motivates DXY to keep the trade in the 91.70 region so far, where sits the 8-month support line.

Against this, bets for a deeper pullback remain on the rise and target the psychological support at 90.00 ahead of the April 2018 lows near 89.20.

Occasional bullish attempts need to surpass the 93.20 level (November 11) to mitigate the downside pressure somewhat. However, as long as DXY trades below the 200-day SMA, today at 95.95, the offered stance is forecast to persist.

DXY daily chart