- DXY’s correction lower extends to the mid-90.00s.

- The next support of note comes in at the 90.00 region.

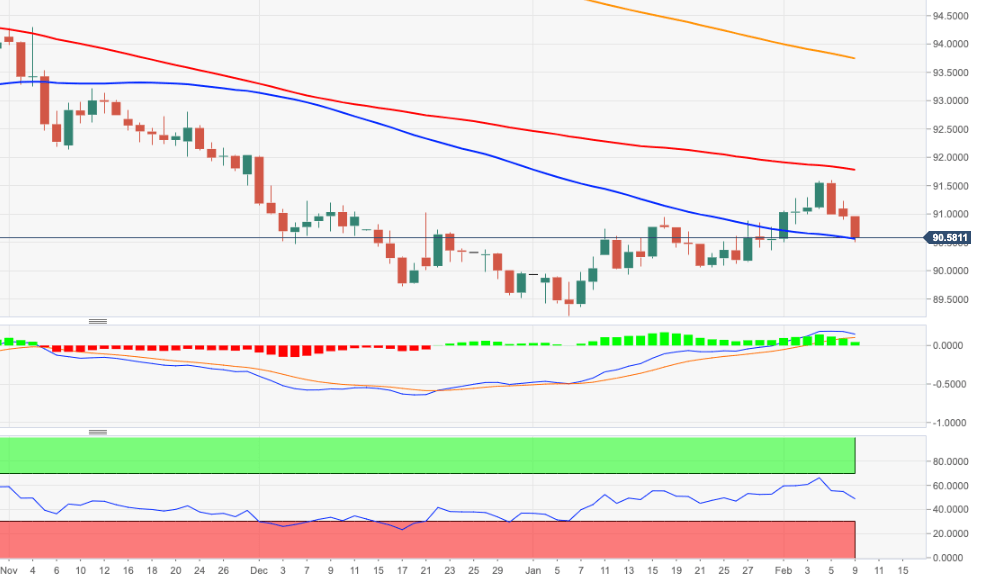

DXY accelerates the downside and navigates multi-day lows in the 90.50 zone on turnaround Tuesday.

Sellers keep hurting the buck and the door is now open for a probable visit to the weekly lows around 90.00 (January 22) in the next sessions. Below this psychological level is located the 2021 lows around 89.20 ahead of the March 2018 low at 88.94.

In the meantime, occasional bouts of upside pressure in the dollar are seen as corrective only and in the longer run, as long as DXY trades below the 200-day SMA, today at 93.74 the bearish stance is expected to persist.

DXY daily chart