- DXY starts the week on the positive note and surpasses 91.00.

- Extra gains should face initial resistance in the mid-91.00s.

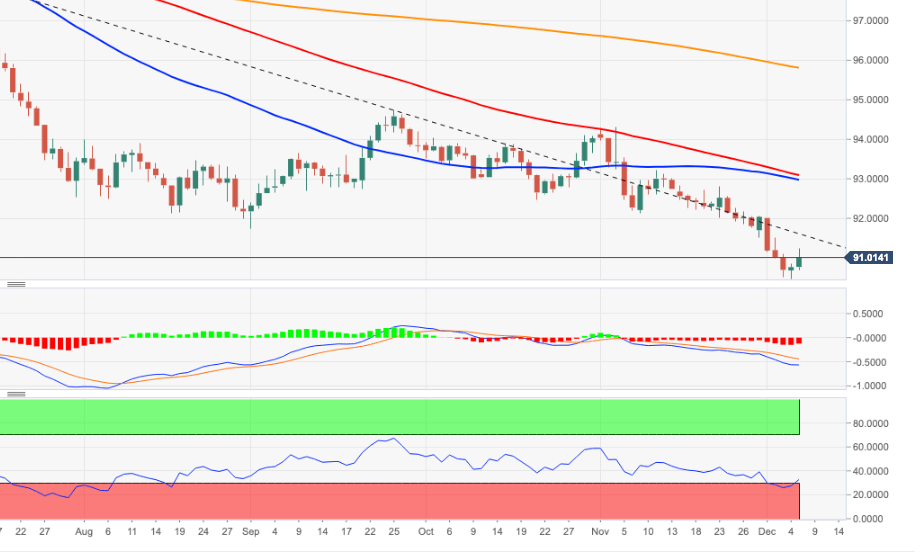

The index manages to regain composure and advances beyond the 91.00 barrier at the beginning of the week.

While the bearish stance is seen unchanged, bouts of buying pressure are expected to meet interim hurdle around 91.50, where sits the 9-month (resistance) line ahead of the Fibo level at 91.92. Above this region, the downside pressure is predicted to mitigate somewhat.

In the meantime, as long as DXY trades below the 200-day SMA, today at 95.80, the negative view is forecast to prevail.

DXY daily chart