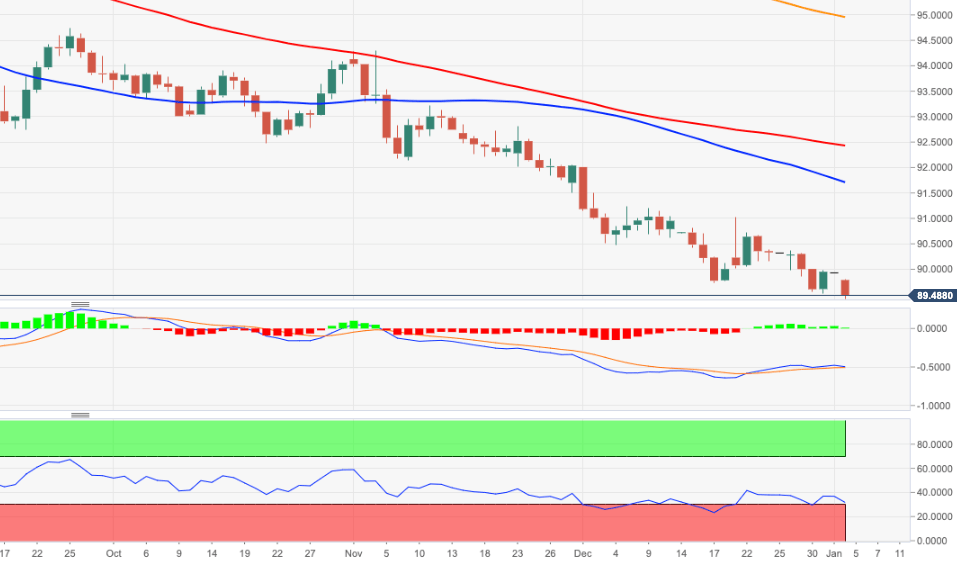

- DXY regains extra selling pressure near 89.40.

- Next on the downside emerges the April 2018 low near 89.20.

The index starts the new year on the negative side and extends the drop to fresh lows in the 89.40 region.

The outlook for the dollar appears well into the bearish territory and therefore further losses remain well on the cards. That said, the next support of relevance comes in at 89.22 (April 2018 low).

The downside pressure is expected to mitigate somewhat on a breakout of the 2020-2021 resistance line, today around 91.80.

In the meantime, as long as DXY trades below the 200-day SMA, today at 94.94, the negative view is forecast to prevail.

DXY daily chart