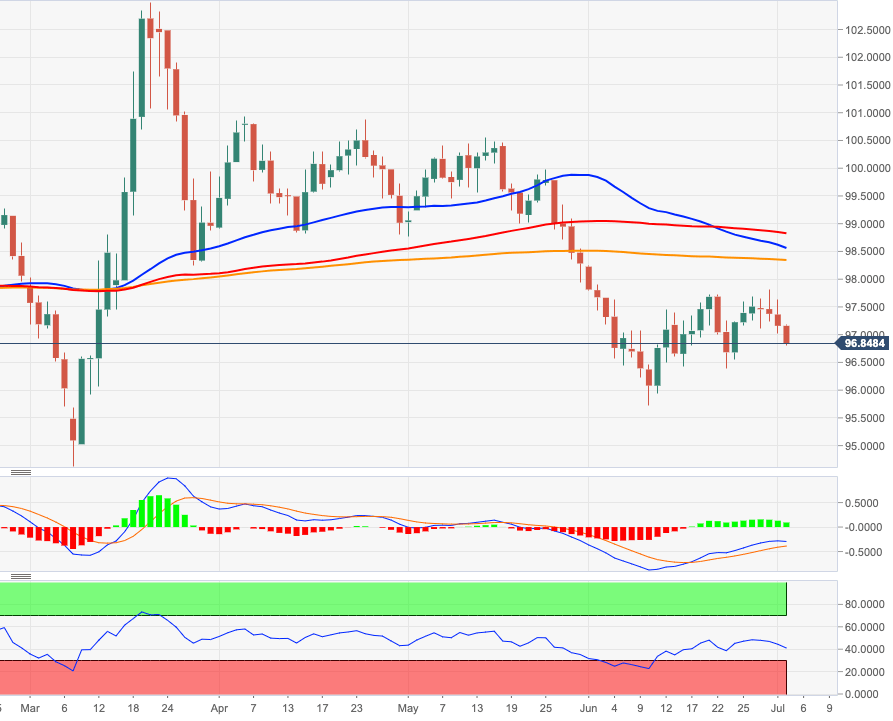

- DXY is accelerating the correction lower to sub-97.00 levels.

- Further south emerges the mid-June lows in the 96.40 region.

DXY is down for the fourth session in a row so far on Thursday on the back of the better mood in the risk appetite trends.

If the selling pressure gathers traction it is expected to expose the 96.40/35 band as the next interim support, area last seen in mid-June.

Looking at the broader picture, the bearish view is seen unhanged while below the 200-day SMA, today at 98.36.

DXY daily chart