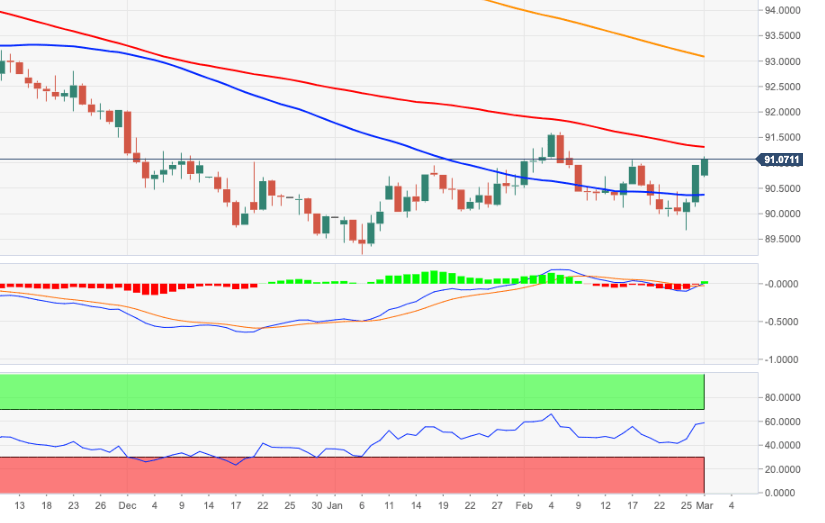

- DXY extends the advance and reclaim the 91.00 yardstick.

- Further north emerge the February peaks around 91.60.

DXY adds to the recent uptick and regain the key barrier at 9100 the figure at the beginning of the week.

While bulls have regained the upper hand the upside momentum can extend to the February tops in the 91.60 zone (February 5), where the rally is seen faltering. Before this key resistance there is a minor hurdle at the 100-day SMA, today at 91.31.

In spite of the ongoing move, further upside in the index is deemed as corrective only amidst the broader bearish view on the dollar. That said, the area above 91.00 and beyond could well represent an opportunity to enter the short trade.

In the longer run, as long as DXY trades below the 200-day SMA (93.08), the negative stance is expected to persist.

DXY daily chart