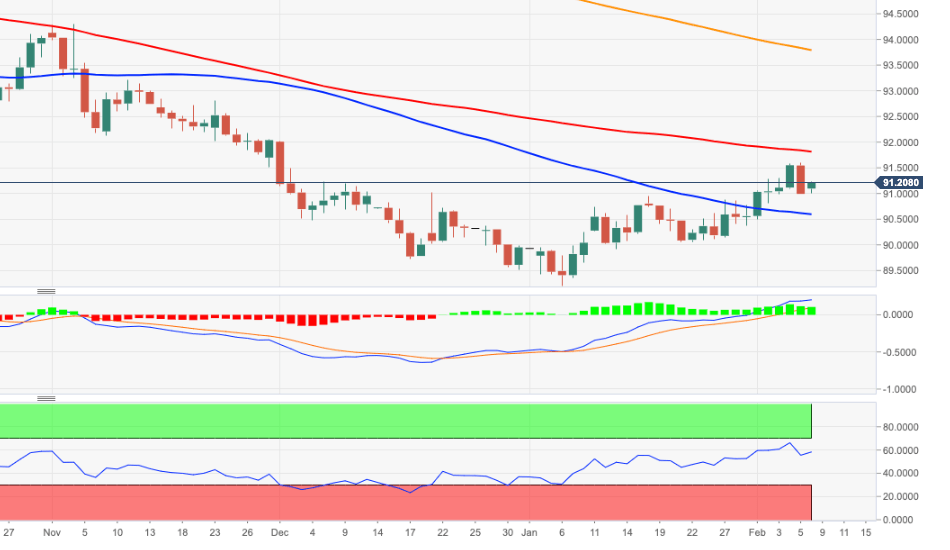

- DXY’s correction lower meets support in the 91.00 region.

- The 100-day SMA around 91.80 caps the upside so far.

DXY manages to bounce off recent lows in the 91.00 neighbourhood.

Sellers failed to drag the index further south of the 91.00 mark, leaving the door open for the continuation of the ongoing recovery in the very near-term at least. Recent yearly tops in the 91.60 region now emerge as the next hurdle of relevance in case the bullish bias regains traction. Further up comes in the 100-day SMA around 91.80.

The ongoing rebound is seen as corrective only and in the longer run, as long as DXY trades below the 200-day SMA, today at 93.78 the bearish stance is expected to persist.

DXY daily chart